“Why is timely payment of rent so difficult for tenants? And why are property managers always chasing overdue payments month after month?”

This is perhaps one of the most common reasons for frustration for property management. For tenants, an exponential hike in living expenses and irregular income patterns make it impossible to pay rent on the first of every month. For landlords and property managers, unpaid or late rent causes cash flow problems and unwarranted anxiety.

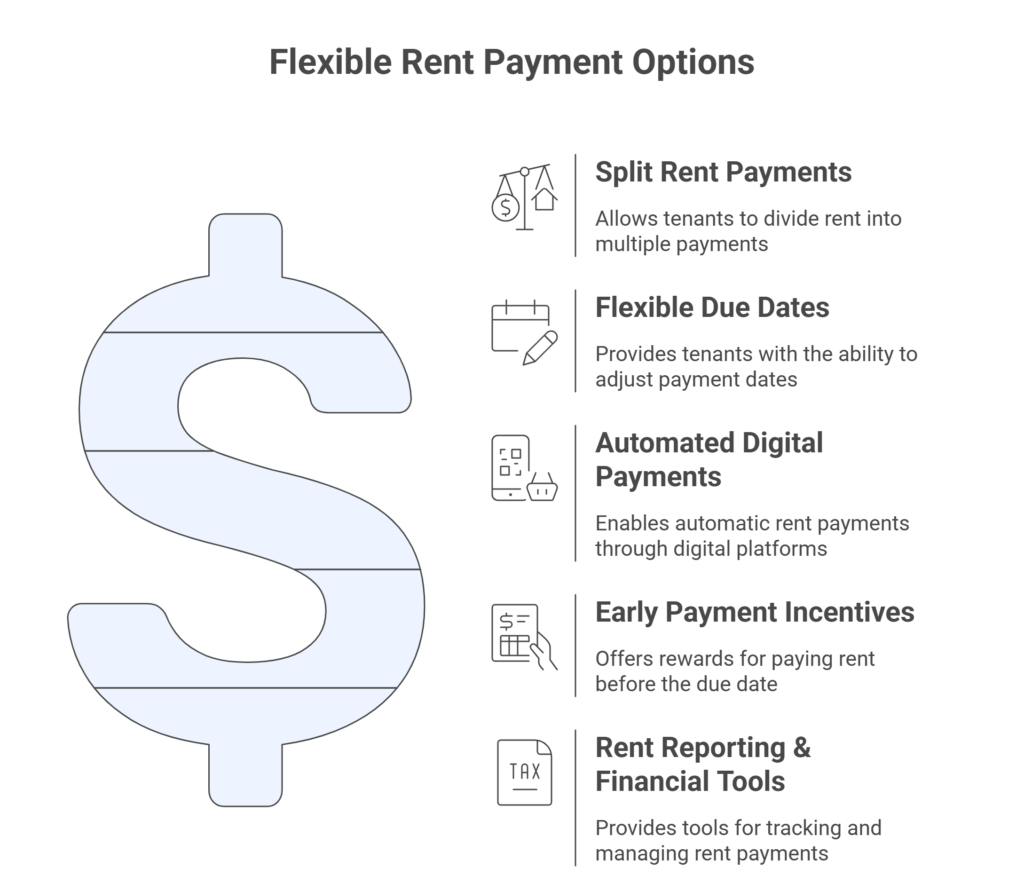

That’s where flexible rent payment options enter the picture. By providing more payment options like breaking rent into smaller payments, adjusting due dates, or providing online payment tools, property managers get a win-win situation. How? Tenants get a breathing room, and property managers get paid more consistently.

Here we have shared six flexible rent payment options that not only minimize late payments but also increase tenant satisfaction and long-term retention.

What Are the 6 Flexible Rent Payment Options?

Here are six successful strategies:

- Split Rent Payments: Permit tenants to pay rent in installments.

- Flexible Due Dates: Tailor rent due dates to correspond with income schedules.

- Grace Periods & Deferred Payments: Offer temporary extensions or delayed rent under extraordinary conditions.

- Automated Digital Payments: Incentivize tenants to pay through automated online systems that collect rent.

- Early Payment Incentives: Give rewards or discounts to tenants who pay early.

- Rent Reporting & Financial Tools: Assist tenants in building credit and making payments more efficiently.

Now, let’s take each option in depth.

1. Split Rent Payments: How Does Paying in Installments Help Tenants?

Split rent payments enable tenants to split their rent into two or more smaller payments rather than pay in one lump sum, which helps simplify cash flow.

Why it works:

A lot of tenants nowadays live paycheck to paycheck. It’s difficult to pay $1,500 all at once, but paying $750 every two weeks is more manageable.

For property managers, it minimizes the risk of missed payments because tenants are able to match rent to their paycheck schedule.

Example:

A bi-weekly tenant can make payments on the 1st and 15th of each month. This way, rather than stressing for the entire amount at the beginning, rent is synchronized with their paycheck schedule.

Property managers who want consistent collections can benefit from automation tools. Platforms like Propertese streamline this process, much like what we covered in how to automate rent collection and eliminate late payments.

2. Flexible Due Dates: Can Tenants Choose When to Pay Rent?

Flexible due dates allow tenants to pay rent on a date that aligns with their income cycle, not just on the first of the month.

Advantages for tenants:

- Syncs with irregular or bi-weekly income.

- Reduces mismatches between paydays and bills, causing stress.

- Advantages for property managers:

- Boosts on-time payments.

- Enhances tenant satisfaction, bolstering retention.

Example:

If a tenant is paid on the 10th, the property manager can adjust their due date. This minor tweak can drastically reduce late payments. For more strategies on improving tenant satisfaction, see our guide on resolving issues and retaining residents with better customer service.

3. Grace Periods & Deferred Payments: Should Property Managers Allow Extra Time?

Grace periods and deferred payments provide short-term leeway to pay rent without penalty to ease tenants during financial distress.

Why it matters:

- Things go wrong: medical expenses, losing a job, or unforeseen costs.

- Granting a little leeway can decrease tenant turnover and avoid expensive evictions.

Types of flexibility:

- Grace Period: A fixed period (e.g., 3–5 days past the due date).

- Deferred Payment: A contract to postpone rent for an extended duration, usually with a repayment schedule.

Tip: Put agreements in writing to prevent confusion.

You can learn more about balancing tenant needs with property performance in our blog on enhancing property management efficiency with Propertese.

4. Automated Digital Payments: Why Should Rent Be Paid Online?

Automated digital payments enable renters to pay rent safely through secure online channels, ensuring consistent, timely collections.

Tenant benefits:

- Convenience: Pay by bank transfer, debit, or credit.

- Set-it-and-forget-it: Automatic withdrawals lower late fees.

Manager benefits:

- Less manual processing.

- Improved records for accounting and tax compliance.

- Integration with property management software such as Propertese.

Fact: As reported by the National Multifamily Housing Council, more than 80% of renters choose to pay online when given the choice.

For property managers considering tools, our guide on choosing the right online rent payment system is a must-read.

5. Early Payment Incentives: Do Discounts Encourage Tenants to Pay Faster?

Early payment incentives, like tiny discounts or rewards, encourage tenants to pay early for better cash flow.

Examples of incentives:

- $25 discount when paying on or before the 25th of the previous month.

- Gift cards or loyalty points for regular early payments.

Why it’s effective:

- Promotes good payment practices.

- Tenants feel rewarded, not punished.

- Managers achieve a more stable cash flow earlier in the month.

For property managers who want to maximize income strategies, check out our post on effective tactics to elevate property management revenue.

6. Rent Reporting & Financial Tools: How Does Reporting Rent Build Credit?

Rent reporting enables tenants to build their credit score through having timely rent payments reported to credit bureaus.

Tenant benefits:

- Assists tenants in building creditworthiness.

- Easier to qualify for mortgages, loans, and subsequent rentals.

Benefits for managers:

- Incentivizes timely payments by tenants.

- Increases the value of the rental product.

Example:

Products such as Experian RentBureau and RentTrack allow property managers to report directly, rewarding timely payments.

To explore more on how financial technology is shaping property management, see our blog on how generative AI is helping property management software.

Why Flexible Rent Payments Benefit Both Sides

Flexible rent payments are more than a convenience. They’re a retention technique and a tool for profitability.

- For tenants: Reduced financial pressure, improved credit, increased satisfaction.

- For managers: More reliable payments, reduced evictions, better tenant relationships.

Consider flexible payments as part of your tenant communication strategy. When managers adjust, tenants are more likely to remain, lowering expensive turnover. For more insights, explore our blog on innovative solutions for efficient tenant communication.

Best Practices for Implementing Flexible Rent Payment Options

- Write clear policies: Always document terms in writing.

- Use property management software: Automate due dates and reminders.

- Provide multiple options: Bank transfer, debit, credit, and mobile wallets.

- Communicate openly: Inform tenants of all available choices.

- Monitor financial impact: Match flexibility with your own income needs.

Final Thoughts

Late payments are always going to be an issue with property management, but flexible rent payment options turn this problem into a benefit.

By providing tenants with alternative payment methods, you eliminate friction, increase satisfaction, and stabilize your cash flow. Whether it’s dividing payments, automating online collection, or encouraging early rent, each method deepens your connection with tenants.

Table of Contents

Stay Updated

Subscribe to get the latest news, industry trends, blog posts, and updates...