Ever spent a crazy weekend before tax season digging through piles of receipts and bank statements? Or realized too late that you’ve been mixing personal and rental expenses for months?

You’re not alone. For many property owners, expense tracking is that necessary evil that always seems to get pushed to tomorrow.

But here’s the reality: poor expense tracking isn’t just annoying – it’s costing you money. Missed deductions, financial blind spots, and hours of wasted time add up fast.

The good news? You don’t need to be an accountant or sacrifice your weekends to get this right.

Why Most Property Owners Struggle with Expense Tracking

Let’s be honest about why expense tracking becomes such a headache:

- It’s tedious – Nobody dreams of spending their evening categorizing receipts

- It’s easily postponed – Until suddenly tax season arrives and you’re drowning in paperwork

- It feels complicated – Especially when you’re not sure what counts as a deductible expense

- It’s error-prone – Research shows manual data entry inevitably leads to mistakes

The result? Financial stress, potential tax errors, and a nagging feeling that you’re leaving money on the table.

Why Proper Expense Tracking Is Worth Your Attention

Before we jump into solutions, let’s be clear about why this matters:

1. Tax Savings That Pay For Your Effort

Even if your property isn’t currently profitable, you still need to report income and expenses on your tax return. More importantly, good records are vital for maximizing tax deductions.

Did you know that missing legitimate deductions like property manager payments, depreciation, and HOA fees can cost you thousands in unnecessary taxes?

2. Clear Financial Decision-Making

How do you know if your property is truly making money if you can’t see the complete financial picture?

Proper expense tracking helps you monitor cash flow and make informed decisions about your investment. Should you raise rent? Replace that aging HVAC system now or wait? Sell the property or hold? Without accurate numbers, you’re essentially guessing.

3. Future Financing and Sales

Banks don’t take your word for it. If you ever want to refinance your property or get lending on another one, they’ll request your financial records.

Similarly, when selling a property, having detailed financials showing its income-generating potential will help you find a buyer and help them secure financing – especially important in commercial lending.

4. Peace of Mind

There’s something truly satisfying about knowing your financial house is in order – no surprises, no scrambling, and definitely no sleepless nights wondering if you’ve made a costly mistake.

7 Essential Records Every Property Owner Must Keep

Before discussing systems, let’s clarify exactly what you need to track:

- Receipts and invoices – From contractors, property managers, utility companies, and supply stores. These prove the expense amount and are your first line of defense in an audit.

- Bank statements – These provide a monthly overview of income and expenses.

Pro tip: use a separate account for property transactions only.

- Proof of rent payments – Documents showing amount paid, date, and property.

- Mortgage documents – Showing monthly payments with breakdowns of principal, interest, taxes, and insurance.

Remember: interest is deductible, principal is not.

- Tax returns – Keep previous returns for reference and comparison.

- Security deposit records – Track collection and any deductions made.

- Tenant screening records – Keep documentation of costs associated with finding tenants.

The Best Expense Tracking Systems for Busy Property Owners

Now for the good part – how to make this process as painless as possible:

1. Spreadsheets: Simple But Limited

Best for: Owners with 1-2 properties who are comfortable with Excel or Google Sheets

When you’re just starting out, spreadsheets seem like the perfect solution:

- They’re essentially free

- You can customize them to your needs

- No learning curve if you’re already familiar with spreadsheet basics

The reality check: Once you grow beyond a couple of properties, spreadsheets become unwieldy. Finding specific transactions, generating reports, and preventing formula errors becomes increasingly difficult.

One spreadsheet strategy that works: Create monthly checklists to ensure recurring expenses are recorded consistently, and separate sheets for profit/loss statements and balance sheets.

2. Accounting Software: Powerful But Potentially Complex

Best for: Growing portfolios where tax optimization is a priority

Intuitive accounting software streamlines expense tracking by:

- Automating expense categorization

- Ensuring precise financial records

- Generating comprehensive reports

Popular options:

- QuickBooks – Comprehensive but can be overwhelming with too many options

- Stessa – Specifically designed for real estate investors and typically more affordable

The learning curve can be steeper, but the time savings are substantial once you’re set up.

3. Property Management Software: The All-in-One Approach

Best for: Owners who want unified property and financial management

Many property management platforms now include accounting tools that track income and expenses within the same system you use to manage properties.

The major advantage? Online rent payments made through these platforms are automatically entered into your bookkeeping – one less thing to manually record.

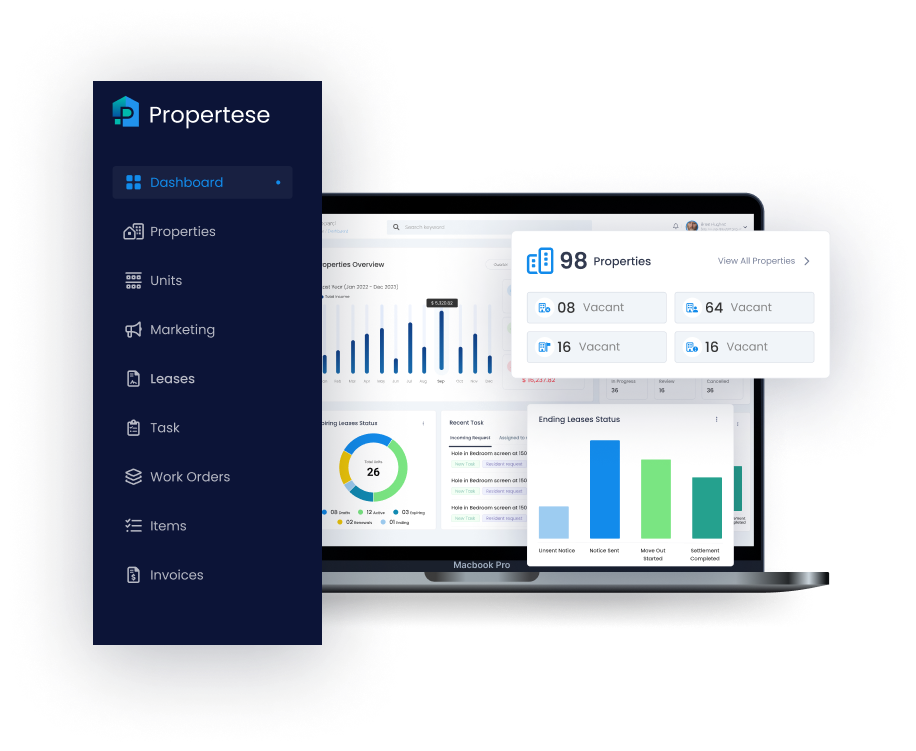

Propertese: The Complete Property Management Solution

Propertese stands out in this category by offering a comprehensive, cloud-based platform specifically designed for property expense tracking and financial management. What makes Propertese different?

- Automated expense tracking and categorization – Say goodbye to manual data entry

- Real-time financial insights – Access up-to-date reports on income, expenses, and cash flow

- Centralized document management – Attach receipts and invoices directly to expense entries

- Customizable expense categories – Track exactly what matters to your portfolio

- Seamless integration – All your financial data syncs automatically in real-time

Unlike generic accounting tools, Propertese is built specifically for property management, meaning you get exactly the features you need without the unnecessary complexity.

4. Dedicated Rental Property Trackers: The Specialized Solution

Best for: Serious investors who want purpose-built tools

Some specialized tools are designed specifically to simplify rental income and expense tracking by automating the entire process.

These specialized trackers offer:

- Real-time insights into cash flow and net income

- Customizable expense categories

- Mobile accessibility

- Trust accounting features

- Automated recurring transactions

While they may cost more than basic spreadsheets, the time savings and financial clarity they provide often justify the expense.

5. The Hybrid Approach: Combining Methods for Maximum Efficiency

Best for: Those who want flexibility with structure

Many successful property owners use a combination of methods:

- Cloud storage (like Dropbox or Google Drive) for digital receipt organization

- Property management software for tenant interactions and rent collection

- Specialized accounting software for financial reporting and tax prep

The key is ensuring these systems work together without requiring duplicate data entry.

6 Best Methods for Tracking Property Expenses Without Spending Hours on Bookkeeping

No matter which system you choose, these practices will dramatically reduce your bookkeeping time:

1. Separate Business and Personal Finances – No Exceptions

This single practice eliminates countless headaches. Use a dedicated bank account and credit card for each property (or all rentals).

This is especially important if your property is held in an LLC, both for tax reasons and liability protection.

When everything property-related flows through dedicated accounts, categorizing becomes infinitely easier.

2. Go Paperless With Digital Receipts

The days of shoebox receipt storage are over. Instead:

- Scan receipts immediately using your smartphone

- Store them in cloud storage or within your bookkeeping software

- Link digital receipts to their corresponding transactions

Propertese’s document management system makes this incredibly simple by allowing you to attach receipts and invoices directly to expense entries. Everything stays organized in one place, making audit preparation and tax season much more manageable.

3. Set Up Automatic Bill Payments

For recurring expenses like mortgage payments, insurance premiums, and utility bills, set up automatic payments from your dedicated property account.

This not only ensures timely payments but also creates consistent, easy-to-track transaction records.

4. Schedule Regular Reconciliation Time

Block 30 minutes weekly or monthly (depending on your portfolio size) to:

- Compare your records with bank statements

- Categorize any uncategorized expenses

- Scan any physical receipts you’ve collected

This prevents the dreaded end-of-year backlog and catches discrepancies early. With Propertese’s real-time financial data synchronization, this process becomes even faster as your accounts are continuously updated.

5. Create Templates for Common Expenses

Whether you’re using spreadsheets or software, create templates for regularly recurring expenses. This saves time and ensures consistency in how you categorize similar transactions.

6. Leverage Automation Wherever Possible

Modern property management platforms like Propertese offer powerful automation features that can transform your expense tracking:

- Automatic expense categorization based on vendor

- Recurring transaction management

- Comprehensive financial report generation

- Real-time data synchronization

These automation capabilities eliminate the most time-consuming aspects of expense tracking, allowing you to focus on strategic property management decisions instead of administrative tasks.

Common Pitfalls and How to Avoid Them

Even with the best systems, watch out for these common traps:

1. Mixing Personal and Business Expenses

This is the number one mistake property owners make. Even small personal purchases on your business card create confusion and potential tax issues.

Solution: Keep business and personal money separate. If you must use personal funds for a property expense, immediately document it and transfer the exact amount from your business account.

2. Inconsistent Record-Keeping

On-and-off tracking leads to gaps in your financial picture and tax-time panic.

Solution: Schedule regular, must-do time for financial management. Even 15 minutes weekly is better than hours of catch-up later.

3. Losing Receipts for Deductible Expenses

Every lost receipt potentially represents a lost deduction.

Solution: Get in the habit of immediately capturing receipts digitally. Many tax professionals recommend apps specifically designed for receipt capture.

4. Not Understanding Deductible Expenses

Property owners routinely overpay taxes by overlooking legitimate deductions.

Solution: Learn about typical rental property deductions including property taxes, insurance, maintenance costs, tenant screening fees, property management software, and depreciation. When in doubt, ask a tax professional who knows real estate.

5. Waiting Until Tax Season

Trying to rebuild a year’s worth of transactions in April is a recipe for stress and errors.

Solution: Use year-round tracking with the systems discussed above. Export your income and expense data regularly to share with tax professionals.

Making the Transition: How to Upgrade Your Tracking System

Ready to improve your expense tracking? Here’s how to make the transition painless:

- Start with a clean slate – Choose a specific date to begin your new system

- Export current data – Clean up your existing records for easier migration

- Begin with core features – Master the essentials before exploring advanced capabilities

- Run parallel systems briefly – Keep your old method as backup during the transition

- Schedule regular check-ins – Set calendar reminders to ensure you’re staying consistent

Remember, the goal isn’t perfection – it’s improvement. Even incremental progress in your expense tracking will yield significant benefits.

The Bottom Line: Time Saved, Money Earned

Good expense tracking isn’t just about keeping tax authorities happy – it’s about maximizing your investment returns and reducing stress.

The most successful property owners know that time spent on proper financial systems pays for itself many times over through:

- Tax savings from maximized deductions

- Better investment decisions based on accurate data

- Less time spent on paperwork

- Reduced stress during tax season

- Clear documentation for financing and property sales

Don’t wait until tax season is looming to get your financial house in order. The best time to improve your expense tracking system is today.

As your portfolio grows, having the right system becomes even more critical. While spreadsheets might work for beginners, platforms like Propertese are designed to grow with your business, providing the automation and insights needed to manage expenses efficiently without hiring additional staff.

Your future self (and your accountant) will thank you.

Ready to Transform Your Property Expense Management?

Which expense tracking method seems right for your property business? The answer depends on your portfolio size, growth plans, and personal preferences.

For those serious about making their operations simpler, Propertese offers a complete solution that removes the headaches of traditional expense tracking. With automated financial management, real-time data updates, and powerful reporting tools, Propertese turns what was once a time-consuming task into a strategic advantage.

The few hours spent setting up an effective tracking system will save you days of stress and potentially thousands in tax savings over the life of your investment. And with Propertese’s easy-to-use interface and helpful support team, that setup process is easier than you might think.

After all, successful property ownership isn’t just about finding good tenants and maintaining properties – it’s about having the right systems to support your growing portfolio without taking over your life.

Ready to see how Propertese can transform your property expense tracking?

Book a free demo today and discover how you can save hours every week while gaining clear financial insights across your entire portfolio.

Table of Contents

Stay Updated

Subscribe to get the latest news, industry trends, blog posts, and updates...