Running a property management company in today’s economy is challenging. Increased maintenance expenses, inflation stress, and the never-ending battle of retaining tenants can leave little profit margin at all. That is why tax savings have become a survival mechanism. One of the strongest methods for property management companies to decrease tax liabilities in 2025 is bonus depreciation. But few property managers know about it or take full advantage of it.

In this blog, we’ll explain exactly how bonus depreciation tax benefits for property management companies work, why they’re important in 2025, and what practical ways you can implement to save you thousands of dollars.

What Is Bonus Depreciation and Why Should Property Managers Care?

It permits businesses to deduct a significant portion of the cost of qualifying assets in the same year they are acquired, instead of spreading the deduction over numerous years.

For property management companies, this can translate into:

- Faster tax write-offs.

- Immediate cash flow perks.

- Additional reinvestment funds.

Example:

If your business purchases $100,000 of new HVAC equipment, you would be able to write off a substantial amount of that expense in 2025 rather than spreading it over 10–15 years. That’s money back in your pocket much earlier.

How Does Bonus Depreciation Change in 2025?

This is the question most property managers are currently asking. Here’s a brief timeline for the depreciation rates:

- 2017–2022: 100% bonus depreciation (thanks to the Tax Cuts and Jobs Act).

- 2023: Reduced to 80%.

- 2024: Reduced to 60%.

- 2025: Drops further to 40%.

- 2026 onward: Phase out entirely unless a new law reverses it.

What does this mean?

In 2025, you can still deduct 40% of qualifying purchases upfront, which is a big deal when applied to expensive property management assets such as building improvements, security systems, or appliances.

Bonus Depreciation vs. Section 179: What’s the Difference?

These two tax tools are frequently confused by property managers. Here’s the difference in simple terms:

Bonus Depreciation:

- No limit on spending per year.

- Can make or increase a loss.

- Automatically applies unless you choose to opt out.

Section 179 Deduction:

- There are spending limits per year.

- Will not create a loss (limited by taxable income).

- You need to elect it specifically.

Important takeaway for property managers:

If you’re purchasing significant assets, bonus depreciation provides more freedom. But combining it with Section 179 sometimes maximizes your tax benefit.

What Assets Can Property Management Companies Write Off with Bonus Depreciation?

This is where bonus depreciation excels for property management. A lot of the assets you’re already spending money on might be eligible.

Here are the best eligible assets:

- Appliances for rental property (refrigerators, stoves, dishwashers).

- HVAC systems and air conditioning equipment.

- Security technology and access control systems.

- Landscaping enhancements (fencing, sidewalks, parking lots).

- Furniture for rental units or shared spaces.

- Computer hardware and software for property management activities.

When investing in property management software, think about how it relates to efficiency. Solutions such as Propertese have already demonstrated how cloud-based real estate management software can change the game. When combined with tax-saving opportunities, the ROI definitely multiplies.

Read more: The significance of cloud-based real estate management software for property professionals.

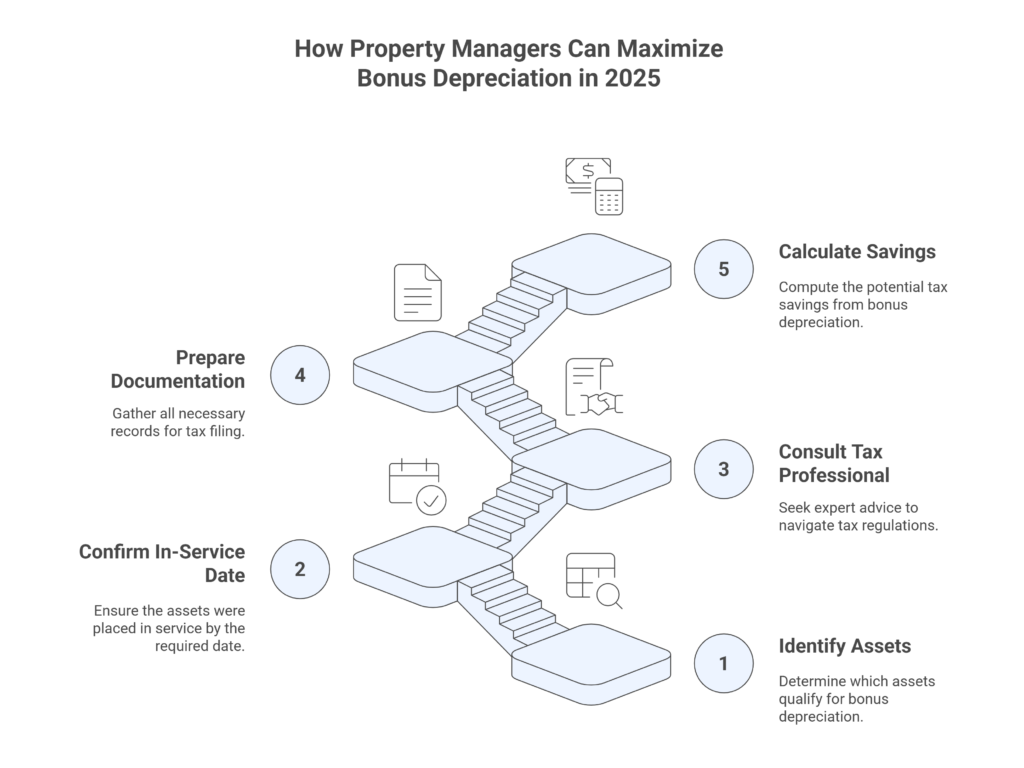

Step-by-Step: How Property Managers Can Use Bonus Depreciation in 2025

To qualify and maximize your savings, here’s the process:

Identify Eligible Assets

Review planned purchases for 2025 (equipment, systems, renovations).

Confirm the In-Service Date

Assets must be placed in service during the tax year (not just purchased).

Work with a Tax Professional

Ensure you’re combining bonus depreciation with Section 179 effectively.

Keep Documentation Ready

Save contracts, installation records, and invoices for audit purposes.

Calculate Your Savings

If you purchase $50,000 worth of new equipment in 2025, bonus depreciation lets you deduct $20,000 (40%) right away.

Why Is Bonus Depreciation Especially Valuable for Property Management Companies?

Property management is a capital-intensive business, with ongoing investments needed to maintain properties’ operational and competitive performance. Bonus depreciation tax savings can be reinvested in:

- Tenant attraction marketing campaigns. (Learn more: Maximizing occupancy rates through effective property management advertising).

- Advanced tenant communication solutions. (Learn more: Maximizing occupancy rates through effective property management advertising).

- Higher efficiency through upgrading property management software. (Check out: Enhancing property management efficiency with Propertese).

This makes a profitability cycle: reduced taxes → greater reinvestment → improved tenant satisfaction → increased revenue.

How Bonus Depreciation Supports Long-Term Growth

Although the percentage is dwindling, bonus depreciation remains a massive victory in 2025. Property management businesses that move quickly can secure savings before the phase-out becomes faster. Combine these savings with:

- Smart financial management systems (organizing your finances with property management charts of accounts).

- Constructive tenant retention strategies (8 key strategies to retain good tenants).

- Investing in AI-enabled property tools (how generative AI is helpful for property management software).

Final Thoughts

The 2025 bonus depreciation tax incentives for property management companies are too good to ignore. Although the percentage decreases, the window of opportunity is still large enough for those who plan ahead.

If you know what qualifies, make strategic purchases, and consult with your accountant, you can save on taxes and reinvest savings in growth initiatives that maintain your competitiveness.

Table of Contents

Stay Updated

Subscribe to get the latest news, industry trends, blog posts, and updates...