Understanding the intricacies of CAM (Common Area Maintenance) reconciliation is essential for property managers, especially those working in the commercial market. It’s a crucial part of the financial management of commercial properties, helping property owners and tenants maintain a clear understanding of their responsibilities. In this guide, we’ll break down what CAM reconciliation is, why it matters, and how property managers can approach it effectively.

What is CAM (Common Area Maintenance) Reconciliation?

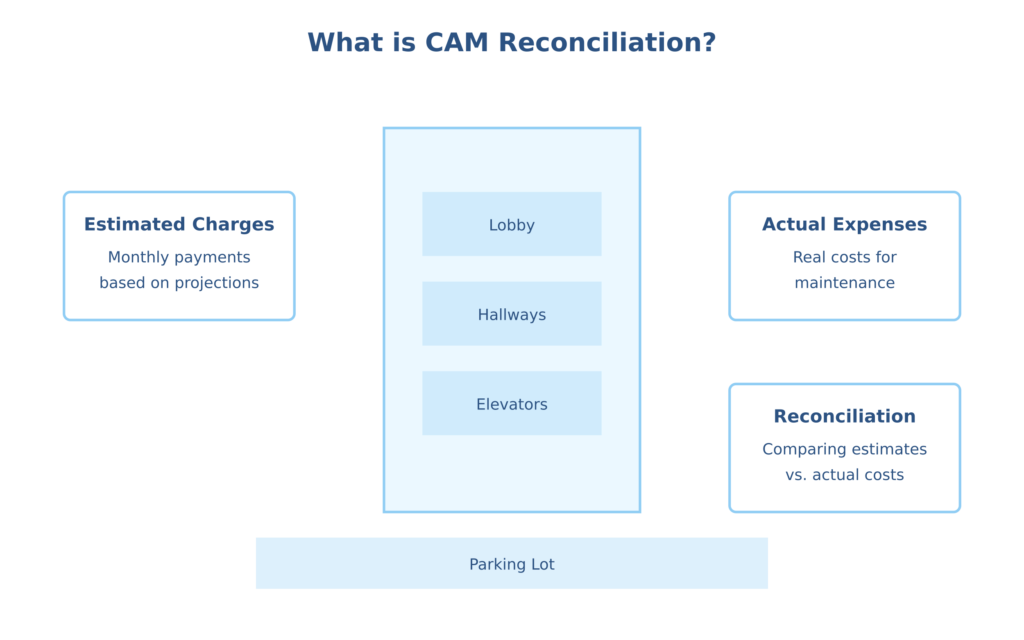

CAM reconciliation is the process of comparing estimated CAM charges with the actual expenses incurred during a specific period, usually a year. The goal is to ensure that tenants are billed fairly for their share of common area maintenance costs and that the property owner or manager recovers the appropriate amount of expenses.

Common Area Maintenance (CAM) refers to the shared areas of a commercial property that are used by all tenants. These areas include hallways, parking lots, elevators, lobbies, restrooms, and other shared spaces. The costs to maintain these areas are typically divided among tenants based on the lease agreement, with each tenant paying a portion of the maintenance costs.

However, these CAM charges are often estimates at the beginning of a lease period, and the actual costs may vary. That’s where reconciliation comes in: to ensure that any overpayment or underpayment is addressed, with tenants either receiving a credit or being required to pay additional fees.

Why is CAM Reconciliation Important?

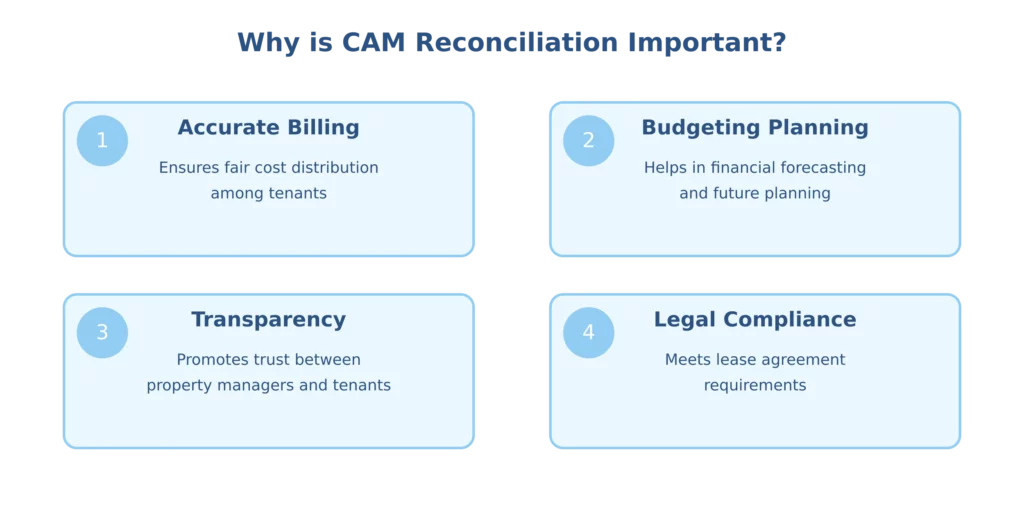

-> Accurate Billing: CAM reconciliation ensures that tenants are billed accurately for their share of common area costs. It prevents undercharging or overcharging, which helps maintain trust between property managers and tenants.

-> Budgeting and Planning: For property managers, it helps in financial forecasting and adjusting the budget for the next year. By reviewing past expenses, you can get a clearer picture of what future costs might look like.

-> Transparency: Tenants want to feel assured that they’re only paying their fair share of costs. CAM reconciliation promotes transparency by providing a breakdown of actual expenses compared to estimated costs.

-> Legal Compliance: Many lease agreements require CAM reconciliation as part of the standard process. Failing to carry out this reconciliation could lead to legal disputes or damage the relationship between tenants and property managers.

How Does CAM Reconciliation Work?

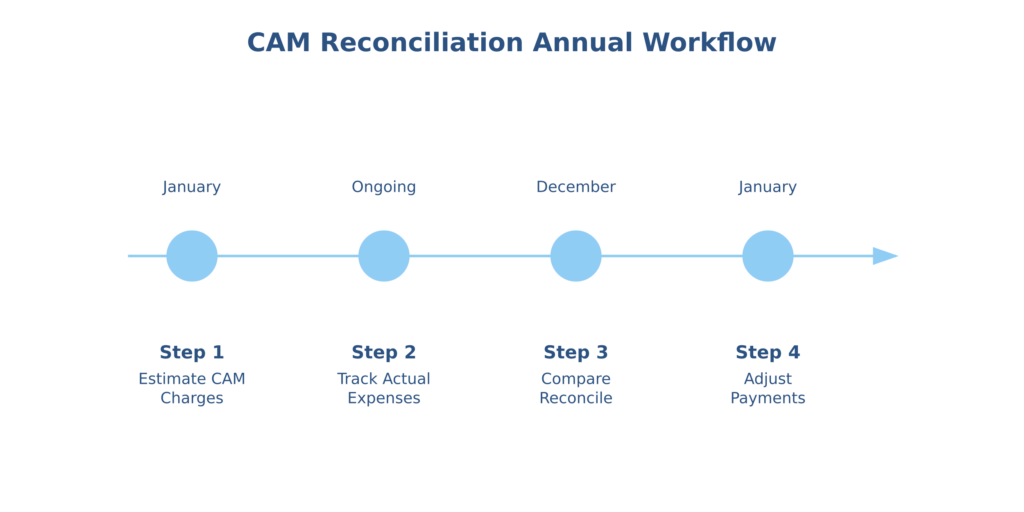

CAM reconciliation typically happens once a year. Here’s a step-by-step guide on how it works:

1. Estimate CAM Charges at the Start of the Year

At the beginning of the lease term or year, property managers provide tenants with an estimate of the CAM charges. This estimate is based on previous years’ expenses and projected costs for the upcoming year. Tenants pay their share of the estimated CAM charges on a monthly basis.

2. Track Actual CAM Expenses

Throughout the year, property managers track the actual costs incurred for common area maintenance. This includes costs like cleaning, landscaping, security, utilities, property management fees, insurance, and repairs.

3. Compare Estimated vs. Actual Costs

Once the year is over, property managers compare the estimated CAM charges with the actual expenses. The comparison will determine whether tenants have paid too much or too little.

4. Issue CAM Reconciliation Statement

After comparing the estimates and actual costs, the property manager prepares a CAM reconciliation statement. This document outlines:

-> The estimated charges for each tenant

-> The actual costs incurred for each category of maintenance

-> The differences (overpayment or underpayment)

-> Any credits or additional payments due from tenants

5. Adjust the Tenant’s Payments

Depending on the outcome of the reconciliation:

-> If the tenant has overpaid, the property manager may issue a refund or apply the credit to future payments.

-> If the tenant has underpaid, they will be required to pay the balance owed, typically in one lump sum or spread out over several months.

6. Repeat the Process

CAM reconciliation is typically performed annually. The process can be repeated each year to ensure that costs are accurately divided among tenants and that everyone is paying their fair share.

Types of CAM Charges

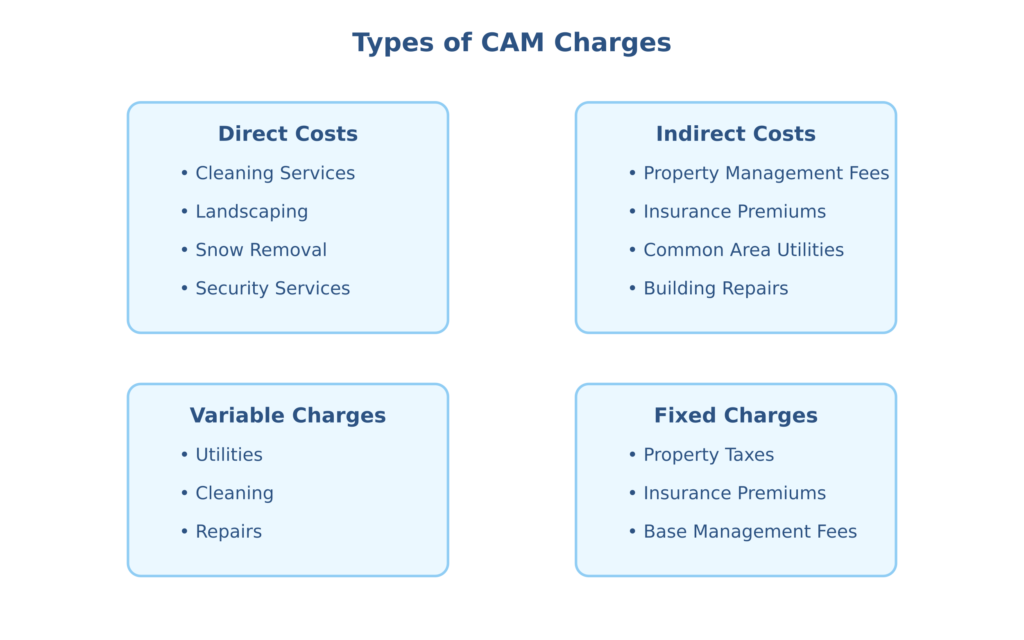

CAM charges can vary based on the type of commercial property and the lease agreement. Some common types of CAM charges include:

1. Direct Costs: These are expenses directly tied to the maintenance and operation of the common areas. Examples include:

-> Cleaning services

-> Landscaping

-> Snow removal

-> Security services

2. Indirect Costs: These costs are associated with the overall operation of the property and may include:

-> Property management fees

-> Insurance premiums

-> Utilities for common areas

-> Building repairs and maintenance

3. Fixed vs. Variable CAM Charges:

-> Fixed Charges: These are consistent year-to-year, such as property taxes or insurance premiums.

-> Variable Charges: These fluctuate based on usage, such as utilities, cleaning, and repairs.

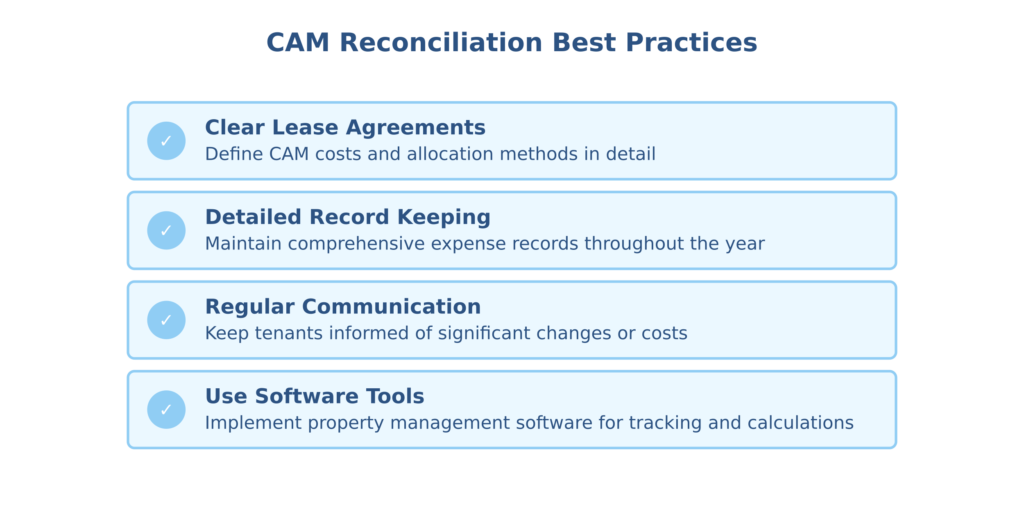

Best Practices for CAM Reconciliation

To make the CAM reconciliation process smoother, property managers can follow these best practices:

-> Clearly Define CAM Costs in Lease Agreements: Before any reconciliation happens, ensure that the lease agreements clearly define which costs are considered CAM and how they will be divided among tenants. This can prevent disputes down the road.

-> Maintain Detailed Records: Keep meticulous records of all common area expenses throughout the year. This will make it easier when it’s time to reconcile costs.

-> Communicate with Tenants: Always keep tenants in the loop regarding CAM charges. If there are significant changes or unexpected costs, let tenants know as soon as possible.

-> Use CAM Reconciliation Software: Property managers can use property management software that tracks CAM charges, automates calculations, and generates reconciliation statements. This can save time and reduce errors.

-> Review CAM Charges Periodically: Don’t wait until the end of the year to review your CAM charges. Periodic reviews can help identify any discrepancies or patterns that could cause issues during the reconciliation process.

Conclusion

CAM reconciliation is an essential process for property managers, helping to ensure that both property owners and tenants are on the same page when it comes to shared maintenance costs. By understanding the basics of CAM reconciliation, maintaining transparency, and following best practices, property managers can avoid conflicts, maintain strong tenant relationships, and ensure the financial health of the property.

By applying this guide, property managers can confidently navigate the complexities of CAM reconciliation and provide accurate, timely, and fair billing to their tenants. Whether you’re managing a small retail center or a large office building, understanding and executing CAM reconciliation is crucial for long-term success.

Table of Contents

Stay Updated

Subscribe to get the latest news, industry trends, blog posts, and updates...