Investing in real estate can be challenging, full of opportunities, risks, and potential gains. To navigate this market successfully, savvy investors rely on data-driven decision-making. They use property metrics, numbers that reveal a property’s investment potential, evaluate risks accurately, and forecast the return on investment.

In this guide, we will unravel the significance of various property metrics. Since there are so many metrics at play, we won’t be able to cover them in this one blog. However, we will cover the essential things a property owner must know.

Understanding Key Property Metrics

Real estate investors rely on property metrics to assess the financial performance of their investments. These metrics offer a way to analyze the economic fundamentals behind real estate investments, regardless of the investor’s experience in the market. Investors can make well-informed decisions by looking at key metrics and positioning themselves for success in a competitive landscape. These metrics include:

Cash-on-Cash Return (CoC)

Arguably, the most straightforward metric to evaluate real estate investments is the Cash-on-Cash Return (CoC). This metric calculates the annual return on an investment as a percentage of the actual cash invested, excluding financing considerations.

It serves as a valuable tool for investors to assess the return on a property solely based on the cash input, providing a clear picture of the investment’s profitability without the influence of financing terms.

Cap Rate

The Capitalization Rate, commonly known as the Cap Rate, is a crucial ratio utilized in estimating the return on investment within the real estate sector. This financial metric is determined by dividing the property’s net operating income (NOI) by its prevailing market value or purchase price.

Investors heavily rely on Cap Rate as it allows them to analyze and compare the potential return on various properties, aiding in their decision-making process.

Gross Rent Multiplier (GRM)

The Gross Rent Multiplier (GRM) is a straightforward metric used in real estate to assess the correlation between a property’s market value and gross rental income. By dividing the property’s purchase price by its annual rental income, GRM offers a rapid and approximate calculation of the time required to recoup your investment solely through rental earnings.

This metric is a valuable tool for investors seeking to gauge a rental property’s profitability and potential return on investment.

Net Operating Income (NOI)

Net Operating Income (NOI) is a crucial financial metric in real estate analysis. It is determined by deducting the property’s operating expenses from its gross income. NOI is a fundamental indicator of the property’s income-generating capacity, providing valuable insights for investors and stakeholders. This metric is handy for evaluating the property’s profitability and operational efficiency.

Additionally, NOI is vital in financial planning, enabling stakeholders to make informed decisions regarding debt service, taxes, and overall investment performance.

Analyzing Metrics for Investment Decisions

Now that we’ve established these metrics, it’s crucial to understand how each can be used to make informed investment decisions.

Analyzing these metrics consistently over an extended period is crucial when evaluating property performance. Observing a continuous increase in Cash-on-Cash Return or Capitalization Rate could signal a potentially more profitable investment opportunity.

On the other hand, a decreasing Gross Rent Multiplier might imply that property values are appreciating faster than rental earnings, prompting a reassessment of the investment strategy.

Furthermore, various properties will exhibit distinct metrics, and it can offer a comprehensive view of the potentially more lucrative investments. For instance, if a property showcases a higher Cap Rate compared to similar properties in the market, it might signal enhanced potential for returns and profitability in the long run.

Analyzing Property Metrics in Investment Decision Making

Once you understand these key property metrics, you can use them to make more informed investment decisions. Start by setting clear investment goals and criteria based on your financial objectives and risk tolerance. Then, use the metrics to evaluate potential properties and compare their financial performance.

Consider market trends and variables such as location, property type, and economic indicators. A thorough analysis of property metrics combined with market research will help you identify lucrative investment opportunities and mitigate risks.

Tips for Maximizing Investment Returns Using Property Metrics

Improve key property metrics such as cash-on-cash return, cap rate, and net operating income to maximize your investment returns. Strategies may include increasing rental income, reducing operating expenses, and optimizing property management.

Mitigate risks associated with property investments by diversifying your portfolio, conducting due diligence, and maintaining adequate reserves for unexpected expenses. Remember to think long-term and consider the potential for appreciation and equity growth.

Tools and Resources for Property Analysis

To effectively analyze and compare properties using these metrics, investors can leverage a variety of tools and resources.

Online Calculators

Several online platforms cater to the needs of real estate investors by providing a wide array of calculators and tools tailored to analyze property investments. These tools are meticulously designed to streamline the process of number crunching, offering investors swift and efficient insights into the potential profitability of different properties. By leveraging these resources, investors can make well-informed decisions and optimize their real estate portfolios.

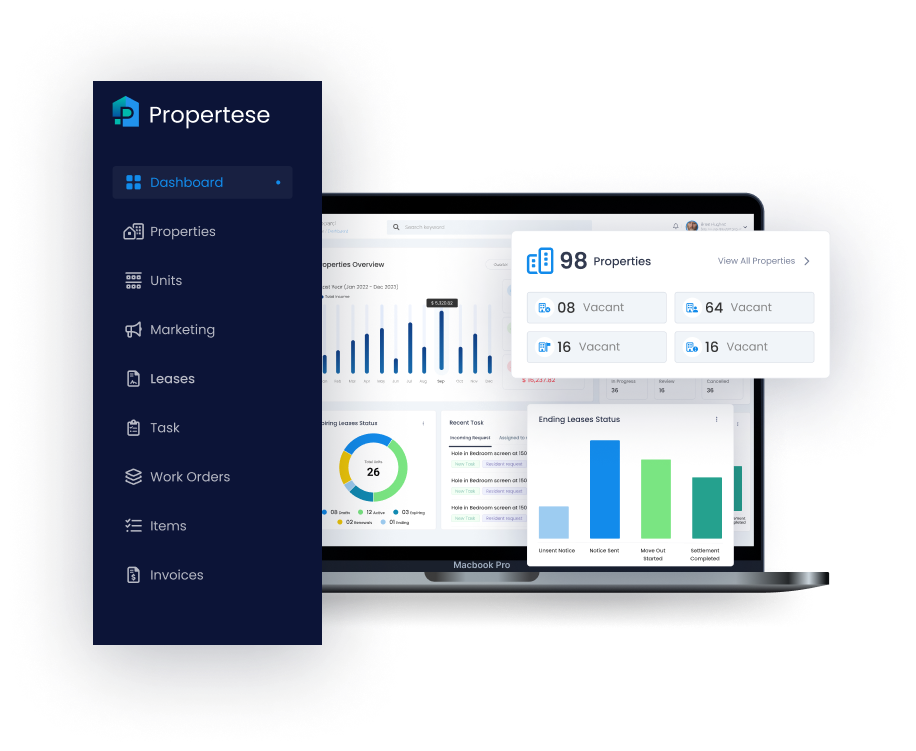

Real Estate Investment Software

Using real estate investment software can be a game changer for experienced and knowledgeable investors with a large portfolio. These powerful software solutions can handle complex computations, do in-depth scenario analysis, and smoothly incorporate data from several sources.

Using these tools, investors can access a thorough study of their real estate investments, allowing them to make informed and strategic decisions for maximum portfolio return.

Conclusion

Property metrics are the foundation of smart real estate investment. They enable investors to mitigate risk, understand the return potential, and make informed decisions that align with their financial goals. By understanding and applying the metrics discussed in this guide, investors can unlock the full potential of their investments and pave the way for long-term success in the real estate market.