Essential Guide to Managing Bank Accounts for Property Management

Managing the financial aspects of your property, whether it’s a business or personal portfolio, is a crucial element of property management. While property management accounting shares similarities with general accounting, it often falls on property owners or managers to handle it themselves.

Fortunately, with the right tools and planning, property management accounting is manageable without needing an accountant. This article will help you fully grasp the ins and outs of accounting and managing a bank account as a property manager.

What is Property Management Accounting?

Property management accounting involves handling the financial aspects of a property, like paying bills and collecting rent. Outgoings can include repairs, maintenance, and landscaping, while incomings mainly come from tenant rent. Some tasks involved are creating invoices, reconciling balances, and preparing financial statements. Efficient property management accounting has its perks, like keeping accurate expense records for taxes and getting a clear view of how profitable your portfolio is for smarter decision-making.

Property Management Bank Accounts

When initiating property management, it’s essential to establish a system for smooth accounting. The first step is often overlooked but crucial: opening a dedicated bank account for property transactions. Using a personal account can lead to confusion during reconciliation. Integrating this account with property accounting software provides a more accurate view of cash flow.

Consideration of the accounting method is vital. Cash-based accounting, where transactions are recorded as they occur, is suitable for individual property managers. Accrual accounting, recording transactions when they happen rather than when money is exchanged, is more appropriate for larger organizations.

Significance of Charts of Accounts

A chart of accounts is like a big filing cabinet that categorizes different accounts into assets, equity, revenue, expenses, and liabilities. Each group has its own smaller groups, and whenever there’s a transaction related to property, it falls into one of these big groups. It’s like keeping things organized!

Speaking of organization, regularly generated reports like balance sheets and cash flow statements are super important. They help with things like reconciling taxes and loan applications. You can use templates with spreadsheets or accounting software to ensure everything is accurate and easily accessible. That way, you save time and avoid mistakes.

Understanding Accounting Terms

Accounts Payable: These are the debts you owe for products or services, encompassing items like appliance repairs or fees. Typically, short-term accounts payable represent something provided on credit.

Accounting Period: Consider an accounting period as a window of time tied to specific accounting functions. Monthly reporting might span from the first to the last day of the calendar month. For tax purposes, it could align with the beginning and end of the financial year.

Accounts Receivable: The counterpart to accounts payable, accounts receivable includes all the money owed to you. In property management, this often consists of outstanding rent balances.

Asset: While the most common asset in property management is the property itself, assets also encompass land, cash deposits, and any valuable items within your portfolio. Essentially, assets are anything with value in your property holdings.

Bank Reconciliation: This process involves comparing your bank accounts against your general ledger. If there’s a discrepancy between your bank balance and what your general ledger indicates, it signals that outstanding amounts may need attention. Monthly bank reconciliation is crucial for identifying and rectifying any discrepancies.

Bookkeeping: The backbone of accounting, bookkeeping involves maintaining your accounting records by diligently recording all business-related transactions. In property management, this ensures a clear and accurate financial trail.

Depreciation: Understand depreciation as the drop in the value of your assets. In the property context, assets could depreciate due to excessive use or deteriorating condition. Grasping depreciation is useful for predicting the value of your assets over time, and certain depreciations can even be written off on taxes.

Expense: Expenses in property management are the costs required to manage your property portfolio. For instance, renting out a property may incur advertising costs and real estate fees, all classified as expenses.

General Ledger: This is the master record of all your transactions. Accounting software updates it automatically, reflecting changes whenever a transaction is paid or received.

Financial Statements: These reports detail various aspects of a property or business’s financial health and status. Depending on the report, it might cover payments made and received, statements for specific accounting periods, or profit/loss statements.

Liability: Liabilities are things for which you owe money. This includes items under accounts payable and mortgage and other loan payments.

Operating Costs: Also known as “overheads,” operating costs are the day-to-day expenses required to maintain and manage your property. This category includes property taxes, insurance premiums, utility costs, common area maintenance expenses, and maintenance and repair costs.

Revenue: Revenue is the raw income generated by your property. In most cases, this comes in the form of rent payments from tenants or the payment for the entire property when it is sold.

Different Ways to Track Your Finances

When it comes to handling the accounting side of property management, you can use two types of principles: accrual basis accounting and cash basis accounting.

Accrual basis accounting is a system where revenue is recorded as soon as it occurs, regardless of when payment is received. This method provides a more accurate representation of your company’s financial position by matching revenue and expenses to the period in which they occur.

On the other hand, cash-based accounting is a system where revenue is recorded only when payment is received. This method is more straightforward, focusing on your company’s cash flow.

Choosing between these principles depends on your company’s needs and financial goals. Accrual basis accounting can provide a more comprehensive view of your company’s financial health, while cash basis accounting offers a more immediate understanding of your cash flow situation.

It’s essential to carefully consider which accounting method is most suitable for your property management business, as it can impact your financial reporting, tax obligations, and decision-making processes.

Top Tips and Best Practices

Track Tax-Deductible Expenses

Come tax time, having a report with all your tax-deductible expenses listed in one place is invaluable. Ideally, label them as tax-deductible when entering them into your ledger to streamline this process. Automated accounting software can be a significant time-saver during tax season.

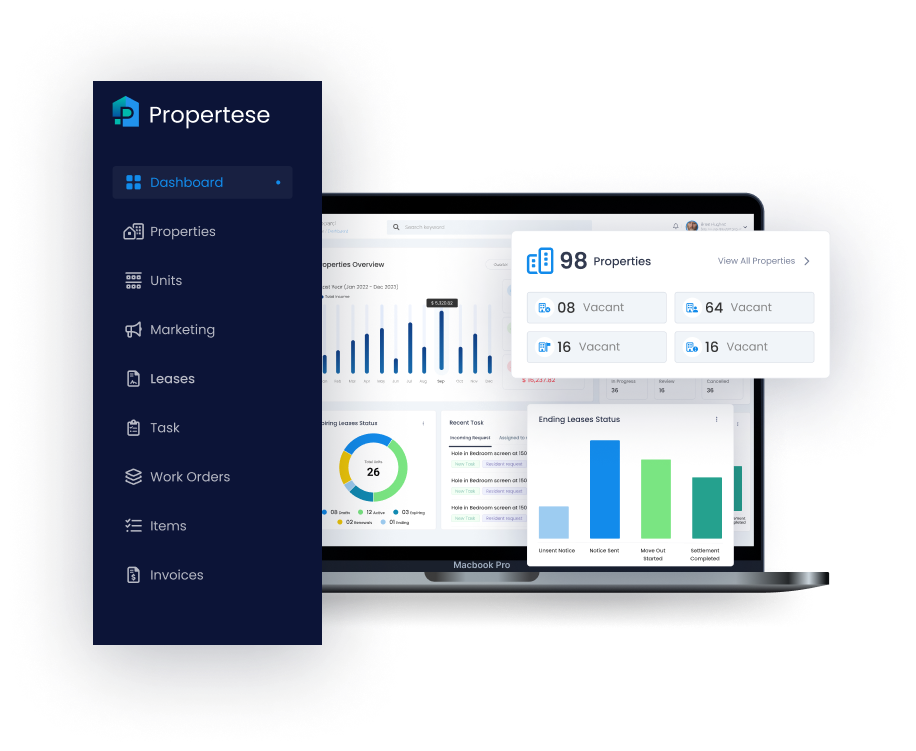

Automate Your Accounting

While manual spreadsheet accounting is an option, accounting software offers a significant advantage in terms of time efficiency, accuracy, and thoroughness. Automated tasks that would take hours to complete manually can be done instantly, allowing you to focus more on the human aspects of property management, such as tenant interactions.

Keep Your Invoices and Receipts Neatly Organized

Given the paperwork-intensive nature of property management, maintaining a well-organized system for invoices and receipts is essential. Even seemingly unimportant documents can become critical when needed. If not using purpose-built property management software, ensure all documents are logically organized for quick access.

Bottom Line

In conclusion, effective property management accounting is crucial for maintaining financial health, making informed decisions, and ensuring compliance with tax obligations. Plus, bank accounts for property management companies are a must to understand the logical terminologies behind them. Establishing a dedicated bank account, choosing the right accounting method, and maintaining a well-organized chart of accounts are fundamental steps.

Familiarity with key accounting terms, such as assets, liabilities, and revenue, is essential for accurate financial tracking. Leveraging automation through accounting software streamlines tasks while tracking tax-deductible expenses and staying organized with invoices and receipts, which are best practices. Whether managing a personal portfolio or a business, mastering property management accounting empowers owners and managers for long-term success.

Table of Contents

Stay Updated

Subscribe to get the latest news, industry trends, blog posts, and updates...