Are you a property manager who oversees rental properties or runs a property management firm? If yes, then you need to understand your success hinges on two things;

- Maximum rental income

- Stay in control of your property data

But how can you achieve this? Well, you need to master the rent roll analysis.

What Is A Rent Roll?

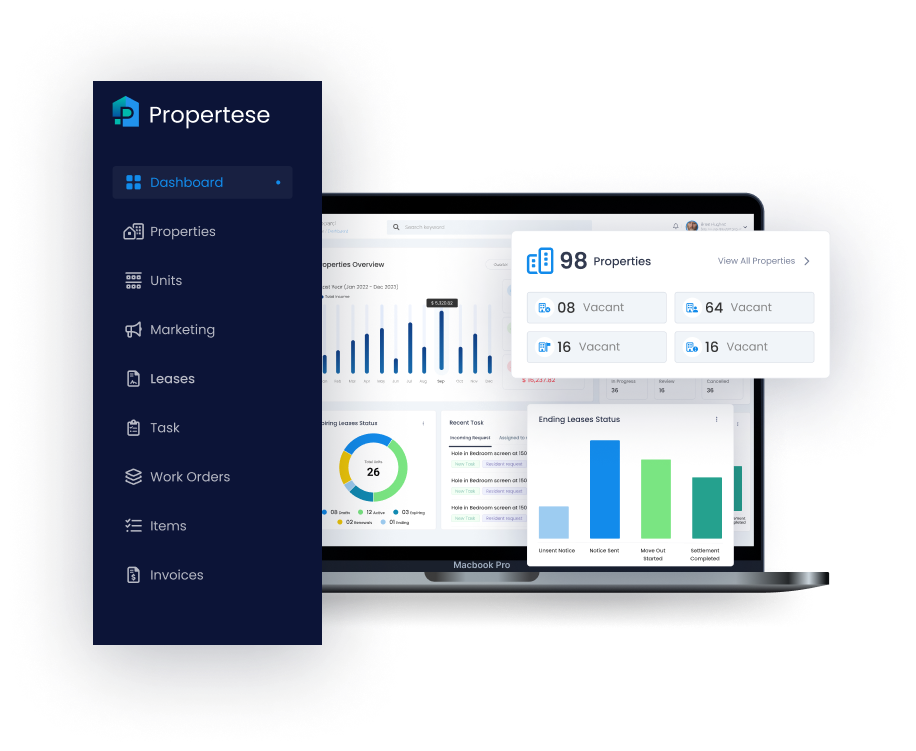

A rent roll is a detailed report holding key information about all your rental units, income, and lease terms. With rent toll analysis, you can evaluate the performance of your properties and forecast revenue to make smarter investment decisions in the future.

Rent roll analysis acts as a financial dashboard for your property management portfolio because it tells you:

- Who your tenants are

- What they are paying or not

- When the leases expire

- How much revenue has been generated

It doesn’t matter if you manage just five residential units or 200+ commercial units; with rent roll analysis, you can always be at the top of new income opportunities as a property manager.

Why Is Rent Roll Analysis Important For A Property Manager?

Multiple reasons explain the importance of rent roll analysis. The most important one is that it works as a management tool. It gives you a clear picture of the business with available vacancies, total monthly income, and any past due rents. So if someone asks you how your business is doing, you can instantly back up your claim with facts and figures.

For example, if your rent roll shows a 15% vacancy across several units, you can calculate the revenue impact, compare it to market averages, and decide whether to adjust pricing or increase marketing spend.

As a property manager, you get a better picture of property pricing with rent roll analysis. This is especially true when you are managing multiple properties and can leverage the rent roll report to draw a comparison between them.

On the other hand, rent roll analysis plays a significant role for buyers and sellers. Having an accurate and detailed rent roll will help you list and market your property in a better way. Prospective buyers are always interested to know about the history of the property, how much reliable income the property will generate for them, and its resale value. With rent rolls, you can share fact-based evidence with buyers to make them believe in the potential return on their investment.

Pro tip: Pairing rent roll insights with property management KPIs gives you an even clearer picture of financial health. of your properties.

Key Components of A Rent Roll

For proper analysis, a standard rent roll must have the following details:

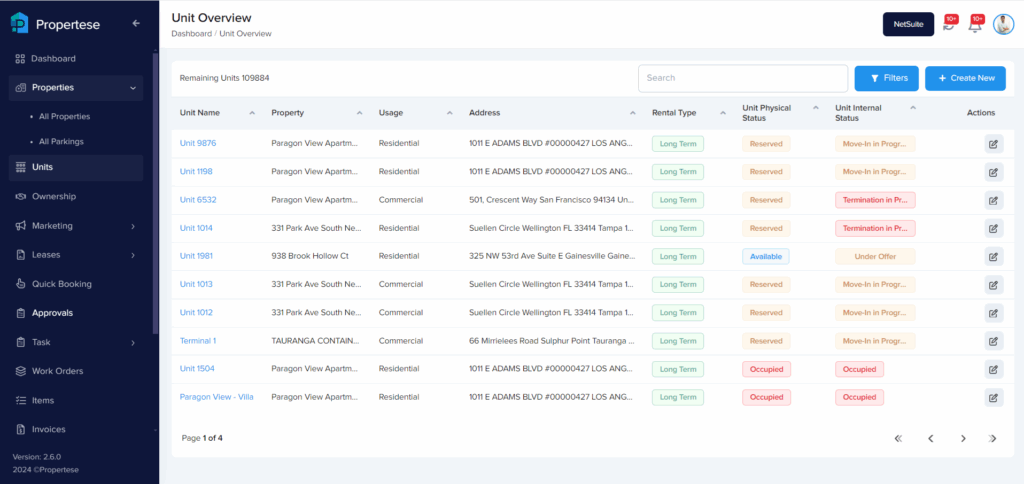

- Tenant Information: Full name and contact details.

- Unit Identifier: Apartment or suite number, floor, or property reference.

- Lease Dates: Start and end dates to track renewals and expirations.

- Rent Amount: Agreed monthly rent.

- Security Deposit: Amount collected as a safeguard.

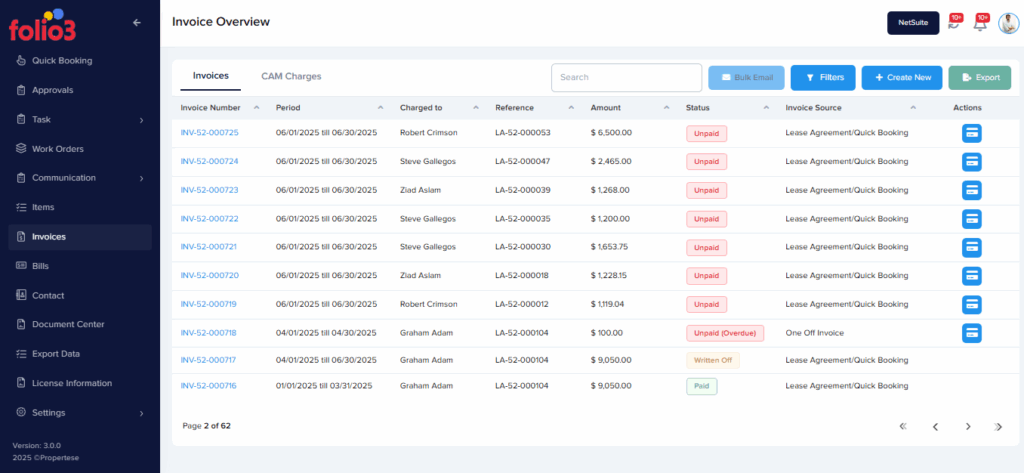

- Payment History: Record of on-time or late payments.

- Outstanding Balance: Any unpaid rent or charges.

Essential Rent Roll KPIs

As a property manager, you should monitor the following KPIs because they drive your rent roll.

- Gross Scheduled Income (GSI): Potential income if all units are rented at full price.

- Vacancy Loss: Income lost due to empty units.

- Concessions & Discounts: Impact of rental incentives on revenue.

- Effective Gross Income (EGI): Actual income after subtracting vacancies and concessions.

- Turnover Rate: Percentage of tenants leaving within a year.

- Collection Rate: Percentage of rent actually collected vs. billed.

- Market Rent Comparison: How your rents compare to average market prices.

Pro tip: If you want to know how well your leasing is performing or identify problems and new opportunities, you need to do a regular rent roll scan. This way, you can verify current revenue, assess gross scheduled income, and look for revenue potential in your portfolio.

You can also use property management bookkeeping best practices to stay on top of financial reporting.

Examples of A Rent Roll Usage

The rent roll usage depends totally on the type of property you manage. Consider that you have the following properties, your rent analysis will help you determine the following:

- As a residential apartments property manager, you can track rent payments, lease terms, and occupancy rates across multiple units with a rent roll.

- If you handle commercial properties, the rent roll will include details about the tenant business type and industry to assess lease portfolio diversity.

- For retail spaces, your rent roll will have information about seasonal variations in rental terms and common area maintenance (CAM) charges.

- For properties with a mix of residential and business tenants, the rent roll combines rental income from different tenant types for easy comparison and administration.

Pro tip: With this rent roll analysis, you immediately know the impact of vacancies and concessions and can focus on marketing or revising rent terms.

Pairing your rent roll analysis with digital marketing strategies for property managers can help you fill vacancies faster.

Summing It All Up

A rent roll analysis can become a powerful asset for property managers, real estate investors, and lenders. With a rent roll analysis, you can easily track rental income, manage tenants, and evaluate a property’s financial performance. All you need to do is a thorough rent roll analysis, and voila, you can now optimize the cash flow, reduce vacancies, and make lucrative investments in the future.

Table of Contents

Stay Updated

Subscribe to get the latest news, industry trends, blog posts, and updates...