There is no denying that accounting and finance management of a homeowners association (HOA) is no small task. Without following HOA accounting best practices, community association managers constantly juggle between balancing budgets and keeping financial records accurate, and between compliance with state/federal regulations. One mistake in accounting, and the trust among homeowners and board members erodes, often resulting in legal and financial consequences.

According to the Community Associations Institute (CAI), approximately 75 million Americans were living in community associations in 2020, with a plausible budget from a few hundred thousand to several million dollars. The number of people has likely grown since then.

Finding the right HOA accounting best practices helps community association managers to provide the best experience to residents and board members, so they can strengthen community trust and run financial operations in a more manageable way.

What is community association management?

What is a community association? To put it simply, a community association is an organization with participating members of the community. It can be a cooperative, homeowners’ association, condo owners’ association, and so forth.

What is the function of a community association? It serves as a governing body with the goal to preserve the community’s common interests and maintain high property values. These associations are led by a group of the board of directors, also known as the HOA or COA board.

Supervising the operations of a community association is community association management. Some of its responsibilities include accounting, financial administration, homeowner communication, service request management, project management, rule creation, and enforcement. As a new manager, you need to familiarize yourself with essential property management techniques.

Why do you need to follow HOA accounting best practices?

Poor financial management can affect every homeowner in the community and can lead to:

- Risk of fraud

- Misappropriation of funds

- Conflict between residents and board members

- Budget restrictions for maintenance

- Non-compliance penalties

These are just some of the many examples of what could go wrong when the books are not accurate. With HOA accounting best practices, community association managers can reduce the above risks and create financial transparency to foster trust and confidence among residents and board members.

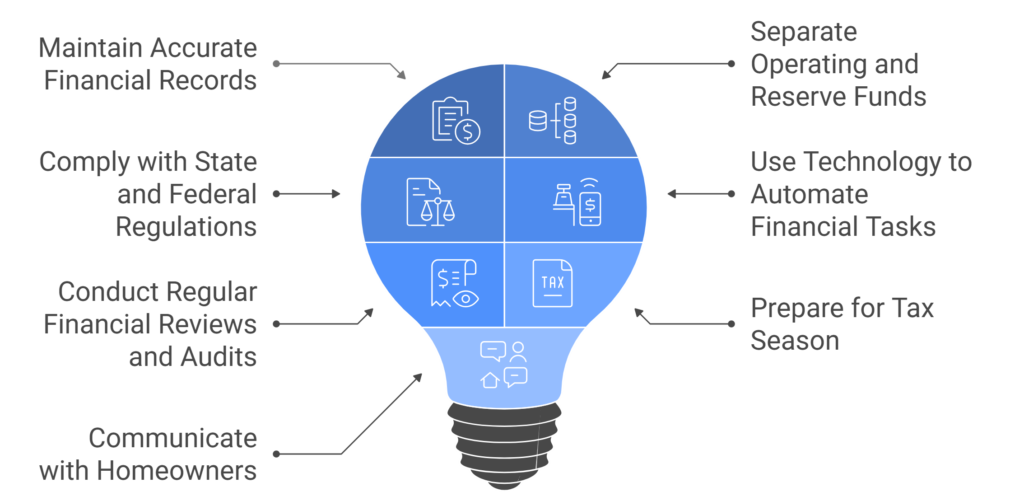

7 HOA accounting best practices for community association managers

Strong accounting practices create a healthy and well-run community association. By following the given HOA accounting best practices, community association managers can bring long-term financial stability to the association.

#1 Maintain accurate financial records

The foundation of any community group is its accurate financial records. Board members cannot make well-informed choices about reserves, budgets, and community projects without transparent reporting. As a community association manager, you need to:

- Record all income and expenses in real time, including dues, late fees, and vendor payments.

- Reconcile bank statements monthly to catch errors early.

- Store invoices, receipts, and contracts in a centralized digital system for easy access.

#2 Separate operating and reserve funds

Mixing the reserve fund with the operating fund is one of the most frequent accounting errors made by HOAs. While operating funds pay for day-to-day expenses, reserve funds are intended for long-term capital projects (e.g., they can be used to replace the roof).

- Create separate bank accounts for reserves and operating budgets.

- Use financial software that allows you to tag transactions accordingly.

- Review reserve studies every 3–5 years to ensure adequate funding.

#3 Comply with state and federal regulations

HOAs are subject to state-specific legislation, and every state may have different requirements for financial reporting. Compliance neglect can put the entire community at risk of penalties, legal action/lawsuits. As a community association manager, you need to better understand the property management requirements by state:

- Keep track of annual filing deadlines (tax returns, audits, and disclosures).

- Familiarize yourself with local HOA regulations or consult a CPA specializing in community association accounting.

- Use software with compliance checklists and reminders to stay on top of deadlines.

#4 Use technology to automate financial tasks

Manual spreadsheets can no longer keep up with modern HOA financial management. You can bring automation in property management financial tasks using generic accounting software like QuickBooks or more niche software like NetSuite to maintain the general ledger and accounts payable/receivable process.

- Accounting software with HOA-specific features like dues tracking and delinquency management.

- Online payment portals make it easier for homeowners to pay on time.

- Automated reporting dashboards that provide real-time financial insights.

#5 Conduct regular financial reviews and audits

Conducting regular audits is beneficial because you get an unbiased assessment of the community’s financials. Auditors vet each financial transaction on your books, including contacting anyone who has done business with your association. Regular audits reinforce financial transparency and act as a safeguard against fraud and mismanagement.

- Schedule annual independent audits by a CPA with HOA experience.

- Conduct internal reviews quarterly to verify consistency.

- Share summarized findings with homeowners to maintain trust.

#6 Prepare for tax season

Keep track of all transactions and frequently reconcile your bank statements to get ready to file your community association taxes early. You can also learn about local, state, and federal tax regulations and how to use tax-advantaged accounts as a community association manager. By doing this preliminary preparation, you’ll have the time to make any necessary corrections, identify any inconsistencies in your books, and steer clear of mistakes that come with a time crunch.

- Schedule annual independent audits by a CPA with HOA experience.

- Conduct internal reviews quarterly to verify consistency.

- Share summarized findings with homeowners to maintain trust.

#7 Communicate with homeowners

To build the element of trust and loyalty among the homeowners and residents, community association managers need to follow the approach of clear communication. To win their confidence, you can:

- Provide monthly or quarterly financial updates in newsletters.

- Host budget workshops before final approval.

- Use digital portals where residents can view financial records, invoices, or meeting notes.

Summing it all up

No HOA community is ever going to be flawless, but what matters is that your organization is constantly working to get better, whether that means you need to upgrade outdated processes, enforce regulations more consistently, or interact with residents more.

The above-mentioned 7 HOA accounting best practices will help you find ways to make community association administration better. Your residents will be happier, and the association will continue to develop with improved community management.

FAQs

First, you need to gather the necessary information on the first day of your current fiscal year. To produce an accurate HOA budget. Send out requests for proposals to get an accurate picture of vendor costs. Compare and evaluate the maintenance and repair costs and utility expenses from last year. Look over your reserve funds and calculate the probable costs for your budget. You can then distribute the HOA budget to your community members for financial transparency.

It is a detailed analysis of the physical condition of the capital components of your association. It analyses the financial health of the HOA’s reserve funds and serves as a solid foundation to form HOA budgets.

HOA fidelity bonds are insurance policies that protect a homeowners association (HOA) from theft, fraud, or embezzlement. It safeguards community finances from criminal conduct by those within the association’s leadership or staff.

It is a documented accounting of the association’s financial operations provided via HOA financial statements. The objectives of an HOA financial statement include:

– Transparency in finances

– Understanding of the objectives of the organization

– Meeting legal requirements

Table of Contents

Stay Updated

Subscribe to get the latest news, industry trends, blog posts, and updates...