Late Rent Payment: Collection Strategies & Legal Options

Late rent payment is not just a cash flow issue. For property managers and portfolio owners, it creates operational drag, legal exposure, and strained tenant relationships. When payments slip, the real question is not whether to act, but how to respond without escalating risk or losing long-term value.

This guide breaks down practical rent payment collection strategies, legal options by situation, and modern systems that reduce repeat delinquency. You will walk away with a clear, defensible framework for handling late payments at scale while protecting revenue and compliance.

If late rent payment follow-ups, reminders, and tracking still rely on manual processes, it may be time to review how your rent payment workflows are structured. Propertese helps property managers centralize rent collection, automate reminders, and track payment behavior in one system, without adding complexity for tenants.

Key Takeaways

- Late rent payment issues are often timing and process failures, not tenant intent, and should be addressed with structured workflows rather than ad-hoc follow-ups.

- Consistent documentation, automated reminders, and clear lease enforcement significantly improve rent payment recovery and legal defensibility.

- Payment flexibility and early intervention outperform aggressive penalties in reducing repeat late payments across portfolios.

- Legal action should be a cost-based decision, not a default response, and works best when supported by clean records and standardized notices.

- Rent management software reduces delinquency by removing manual gaps, enforcing consistency, and improving payment visibility at scale.

Why Are Late Rent Payments Becoming More Common?

Late rent payment patterns have shifted. What was once a tenant-level issue is now often a systems-level problem.

Structural factors behind late rent payment

- Non-traditional pay cycles and variable income

- Rising housing cost pressure in urban markets

- Processing delays tied to manual or fragmented payment methods

- Lack of real-time visibility into payment status

Research from the Urban Institute and the Harvard Joint Center for Housing Studies consistently shows that many late payments are short-term liquidity issues. This distinction matters because collection strategies should differ based on intent, not assumption.

Why Do Late Rent Payments Happen More Often Than Before?

Late rent payment behavior has shifted over the last decade. It is no longer limited to chronic non-payers.

Structural factors driving delays

- Wage volatility and non-traditional pay cycles

- Rising housing cost burden in major metros

- Increased reliance on digital payments with processing lag

- Short-term liquidity gaps rather than long-term inability to pay

Industry research from the Urban Institute and Harvard Joint Center for Housing Studies consistently shows that many late payments are timing issues, not refusal to pay. This distinction matters because strategy should differ based on intent and risk profile.

What Are the First Steps to Take When Rent Payment Is Late?

The first response sets the tone for recovery and defensibility.

Start with verification, not enforcement

Before reaching out:

- Confirm the lease-defined grace period

- Verify payment method status and processing timelines

- Document the missed rent payment internally

Consistency at this stage is critical. Courts often scrutinize whether enforcement is applied uniformly across tenants.

Use early, neutral communication

A short reminder framed around status, not threat, outperforms aggressive language. Automated follow-ups sent immediately after the grace period significantly reduce late rent payment without damaging tenant relationships.

Many teams reduce repeat delinquencies by implementing automated rent payment reminders that trigger based on payment status rather than manual checks.

How Should Late Fees Be Applied Without Increasing Disputes?

Late fees are a tool, not a punishment.

Best practices for late fees

- Apply only after grace periods defined in the lease

- Use flat fees or capped percentages aligned with state law

- Communicate fees clearly and immediately

Several competitors highlight that excessive or surprise fees increase disputes and chargebacks. Courts tend to side with tenants when fees appear punitive rather than compensatory.

State-level caps vary widely. Always cross-check with current statutes and fair housing guidance.

When Do Payment Plans Make Sense for Late Rent Payment?

One gap across weaker content is nuance around repayment plans. Strong competitors address this directly.

When payment plans work

- One-time hardship with prior good payment history

- Short-term income disruption with documented recovery

- Multi-unit portfolios where vacancy costs exceed delay risk

How to structure effective plans

- Written addendum with dates and amounts

- Auto-pay requirement for future rent payment

- Clear default consequences

Payment plans should be tracked inside rent management software, not spreadsheets. Manual tracking is a leading cause of missed enforcement and inconsistent follow-up.

What Legal Options Exist for Ongoing Late Rent Payment?

Legal escalation should be deliberate, not reactive.

Notice types commonly required

- Pay-or-quit notices

- Cure-or-quit notices

- Demand for possession

The exact notice period depends on jurisdiction. According to guidance from Nolo and state housing authorities, improper notice formatting or timing is one of the most common reasons eviction cases fail.

When legal action is appropriate

- Repeated late rent payment despite documented warnings

- Broken payment plans

- Evidence of bad-faith nonpayment

Legal action is not always the fastest path to recovery. Competitors that emphasize eviction without cost analysis overlook court delays, legal fees, and vacancy risk.

How Do Courts View Late Rent Payment Patterns?

Judges focus on patterns and process.

Factors courts commonly review

- Consistency of enforcement across tenants

- Clarity of lease language

- Documentation of communication and notices

- Reasonableness of fees and penalties

A standardized rent collection process strengthens your legal position and reduces ambiguity.

How Can Technology Reduce Late Rent Payment at Scale?

Late rent payment prevention is largely operational.

Why digital rent payment matters

Moving rent payment online improves timing, transparency, and recovery rates. Digital systems surface failed transactions faster and provide real-time visibility across portfolios.

Property managers who adopt online rent payments often see fewer delays caused by processing gaps and manual handling.

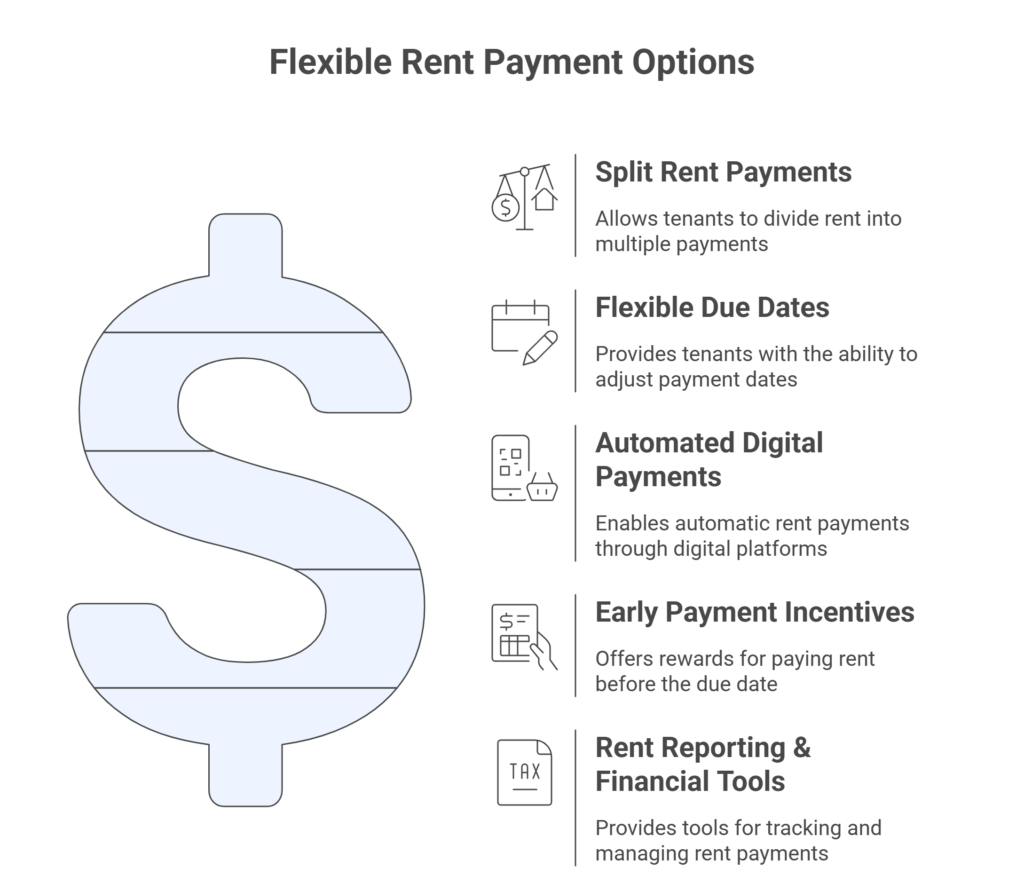

Payment method flexibility as a recovery tool

Allowing multiple payment methods gives tenants options during short-term cash gaps.

Offering flexible rent payment options reduces delinquency when paired with clear policies and automated enforcement.

Credit cards can also be useful in specific scenarios. Before enabling them, teams should evaluate fees, dispute exposure, and tenant behavior patterns associated with credit card rent payments.

What Role Does Rent Management Software Play?

Rent management software is not just about collecting money.

Capabilities that reduce late rent payment

- Automated reminders and notices

- Centralized lease and payment records

- Payment plan tracking

- Reporting on delinquency trends

A structured system replaces ad-hoc follow-ups with consistency. Many portfolios begin by formalizing workflows using a documented rent collection framework that scales with growth.

How Should You Decide Between Legal Action and Operational Resolution?

This decision should be financial, not emotional.

Compare total cost scenarios

| Option | Time to Resolution | Direct Cost | Risk |

| Payment plan | Short | Low | Medium |

| Legal notice | Medium | Medium | Medium |

| Eviction | Long | High | High |

Strong operators reassess at each stage rather than defaulting to escalation.

What Are the Best Next Steps for Reducing Late Rent Payment Long-Term?

Late rent payment is best solved upstream.

Actionable improvements

- Standardize rent payment workflows

- Shift to digital-first payment collection

- Use data to segment risk

- Enforce consistently, document always

The portfolios that win treat rent collection as a system, not a series of conversations.

Frequently Asked Questions

What is the most effective first response to late rent payment?

A neutral, documented reminder sent immediately after the grace period. Automation improves consistency and recovery speed.

Can rent management software reduce late payments?

Yes. Automated reminders, digital payments, and tracking reduce both timing delays and enforcement errors.

Should I accept partial rent payment?

Only with a written payment plan. Accepting partial payment without documentation can weaken legal remedies.

When should legal action start?

After repeated late rent payment or broken agreements, and only after proper notices are issued per state law.

Are late fees always enforceable?

No. Fees must comply with lease terms and state caps. Excessive fees increase dispute risk.

Final Takeaway

Late rent payment problems grow when handled inconsistently or emotionally. They shrink when addressed with clear policy, documentation, and systems that remove friction before conflict begins.

If you want better visibility into rent payment status, fewer follow-ups, and more consistent enforcement across your portfolio, explore how Propertese supports structured rent management with automation, flexibility, and clear reporting designed for growing property operations.