Property Management Insurance remains one of the most misunderstood compliance areas in U.S. real estate operations.

Many property managers believe insurance is required “by law.” Others assume every state mandates the same policies. In practice, there is no federal law that requires property managers, as a profession, to carry insurance.

What exists instead is a layered system of state labor laws, real estate licensing rules, escrow regulations, and contract-driven obligations. These layers are often conflated, which leads to unnecessary coverage in some cases and serious compliance gaps in others.

This guide explains Property Management Insurance requirements by state in clear terms, focusing on what is legally required, what is tied to licensing, and what is driven by owner and lender expectations in 2026.

Across multi-state portfolios, Propertese works with property managers who face overlapping insurance and compliance obligations. The most common issue is not lack of coverage, but confusion between statutory requirements and contractual assumptions. This guide addresses that gap.

Why Property Management Insurance requirements vary by state

Insurance obligations for property managers differ because states regulate property management through different legal mechanisms, not a unified national framework.

Most requirements originate from four factors:

- Employment status

Workers’ compensation laws apply once a firm hires employees, including part-time staff in many states. - Real estate licensing rules

Some states require specific insurance, such as Errors and Omissions coverage, as a condition of maintaining an active license. - Handling of trust or escrow funds

When a property manager holds rent or security deposits, states often require bonding or proof of financial responsibility. - Business structure and operational scope

Sole proprietors, LLCs, and broker-led firms may face different thresholds even within the same state.

Understanding these distinctions matters more than memorizing policy names.

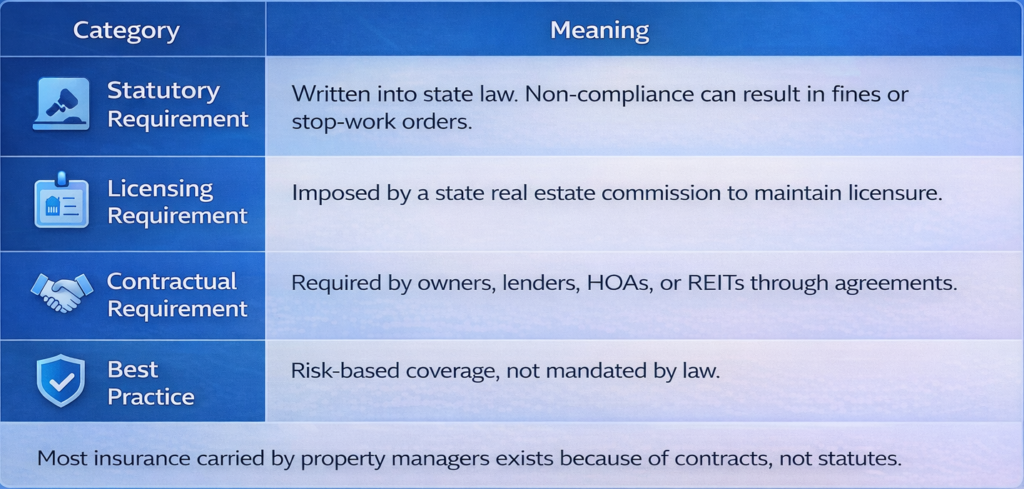

Four categories of insurance requirements every manager should understand

Before reviewing state-level rules, it is essential to separate legal obligations from business expectations.

Core insurance types and when they become mandatory

- Workers’ Compensation

What it covers

Medical costs and wage replacement for job-related injuries.

When it becomes legally mandatory

Triggered once a firm has employees. Thresholds vary by state and can start with a single employee.

Who enforces it

State labor or workers’ compensation departments.

Guidance is typically based on standards published by bodies such as the National Council on Compensation Insurance.

- General Liability

What it covers

Third-party bodily injury and property damage claims.

When it becomes legally mandatory

Not required by statute for property managers in any U.S. state.

Who enforces it

Owners, lenders, and commercial agreements.

General liability is almost always a contractual requirement rather than a legal one.

- Professional Liability (Errors and Omissions)

What it covers

Claims tied to professional negligence, administrative errors, or fair housing violations.

When it becomes legally mandatory

Required only in certain states as a licensing condition.

Who enforces it

State real estate commissions where mandated. Licensing rules are typically published by state agencies and tracked through organizations such as ARELLO.

- Fidelity Bond or Trust Account Bond

What it covers

Protection against misuse or theft of client funds held in trust.

When it becomes legally mandatory

Triggered when a property manager handles rent or security deposits on behalf of others.

Who enforces it

State real estate licensing authorities.

Handling of trust or escrow funds is one of the most consistently regulated activities across states. Many firms rely on centralized controls to manage these obligations, especially when operating across portfolios.

- Cyber Liability

What it covers

Exposure from breaches involving tenant or owner data.

When it becomes legally mandatory

Not directly mandated, but liability arises through state data privacy laws after a breach. Oversight often falls under state attorneys’ general offices and federal consumer protection guidance.

- Commercial Auto

What it covers

Business use of vehicles for property showings, inspections, or maintenance.

When it becomes legally mandatory

Required if vehicles are owned or regularly used for business purposes.

- Umbrella or Excess Liability

What it covers

Additional coverage above base policy limits.

When it becomes legally mandatory

Never required by statute. Often imposed by institutional owners or lenders.

How insurance requirements change as portfolios grow

Insurance obligations do not remain static as a property management business expands.

A firm managing a handful of units without employees faces a very different compliance profile than a firm managing hundreds of units across multiple states. Growth introduces new triggers:

- Hiring maintenance or leasing staff activates workers’ compensation laws

- Managing third-party assets increases fiduciary exposure

- Higher rent volumes increase scrutiny of trust accounts

- Expansion into new states introduces new licensing requirements

Growth also increases enforcement likelihood. Larger portfolios face more frequent audits, owner reviews, and lender diligence. Insurance certificates are examined during license renewals, owner onboarding, and financing approvals.

For firms managing multi-state portfolios, tracking obligations without fragmentation becomes difficult. Many teams rely on structured portfolio management processes to maintain clarity as operations scale.

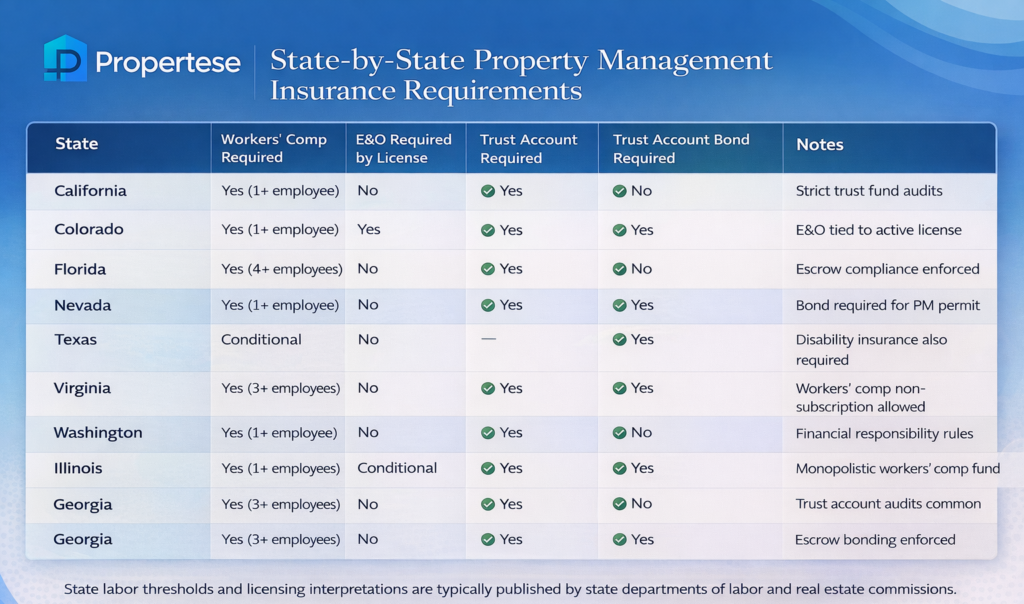

State-by-state insurance requirements (simplified view)

Important

“Not required by statute” means no explicit state law mandates insurance for the property management business itself. Licensing and escrow rules may still apply.

State departments of labor and real estate commissions typically publish state labor thresholds and licensing interpretations.

How to read state requirements without misinterpreting them

A common mistake is assuming that “not required by statute” means insurance is unnecessary. In reality, most states regulate property managers indirectly.

Workers’ compensation statutes apply broadly to employers. Trust account rules appear inside real estate licensing regulations. Professional liability requirements often appear as licensing conditions rather than insurance statutes.

Understanding how a state enforces its rules matters as much as understanding what the rule says. Some states actively audit trust accounts and licensing compliance. Others rely on complaint-driven enforcement.

Most experienced operators treat state requirements as minimum baselines, then layer contractual obligations on top to avoid gaps.

Legal requirements vs contractual expectations

Most insurance requirements encountered by property managers arise from contracts rather than laws.

These obligations usually come from:

- Property management agreements

- Lender underwriting standards

- HOA bylaws

- REIT operating policies

Standard contract-driven requirements include:

- General liability minimums

- Professional liability coverage

- Additional insured endorsements

- Umbrella coverage for higher-risk assets

Property managers who document insurance obligations alongside management agreements reduce disputes between legal compliance and owner expectations. Many firms rely on reporting and documentation systems to maintain consistency.

What audits and disputes usually reveal

Insurance issues rarely surface in isolation. They appear during license renewals, owner onboarding, trust account audits, injury claims, and contract disputes.

When problems arise, the issue is usually one of the following:

- Coverage exists but does not match contractual terms

- Trust account bonding has lapsed

- Workers’ compensation was incorrectly waived

- Certificates of insurance are outdated

- Coverage limits do not align with agreements

Regulators and courts evaluate actual operations, not intent. If employees exist, labor laws apply. If funds are handled, fiduciary rules apply.

Common misconceptions about Property Management Insurance

“Every state requires property managers to have insurance.”

False. No state has a blanket insurance statute for property managers.

“General liability insurance is required by law.”

False. It is almost always contract-driven.

“Errors and Omissions insurance is mandatory everywhere.”

False. Only a limited number of states mandate it through licensing.

“Managing one property means I am exempt.”

Often false. Workers’ compensation and escrow rules may still apply.

Compliance checklist for property managers

Legally required

- Workers’ compensation if employees exist

- Trust account bond if handling client funds

- Commercial auto if vehicles are used for work

Operationally expected

- General liability

- Errors and Omissions coverage

- Cyber liability

- Umbrella coverage for institutional clients

State-specific guidance should always be verified through official sources such as state real estate commissions and labor departments.

Property Management Insurance FAQs (U.S.)

Is Property Management Insurance required by law in the United States?

No. There is no federal law requiring property managers to carry insurance.

Do all states require Errors and Omissions insurance?

No. Only a small number of states require E&O coverage as a licensing condition.

When is a trust account bond legally required?

When a property manager handles rent or security deposits in states that mandate escrow protection.

Is general liability insurance mandatory?

No. It is typically required through contracts, not statutes.

Does Texas require workers’ compensation for property managers?

Texas allows non-subscription, but opting out removes certain legal protections.

Why do owners assume insurance is required everywhere?

Because management agreements and lender requirements commonly mandate coverage.

Final note

Property Management Insurance is not about buying every available policy. It is about understanding which obligations come from law, which come from licensing, and which come from contracts.

For firms operating across multiple states, separating these layers is essential for compliance and credibility. If you want help reviewing insurance obligations across jurisdictions and aligning them with operational reality, Contact Propertese.

Table of Contents

Stay Updated

Subscribe to get the latest news, industry trends, blog posts, and updates...