Let’s assume your HOA has recently found a leaky roof over a clubhouse, and the reserve fund is not enough to pay for repairs. Homeowners are turning to you, the community manager, for solutions. Regular dues aren’t going to do the trick. You need to have a means of raising funds quickly without causing long-term financial hardship. That’s where HOA special assessments come in. But here’s the catch! Homeowners don’t often welcome unexpected expenditures. Poor communication can cause frustration, pushback, or even litigation (legal disputes).

This guide lays out everything you need to know about what a special assessment is and how to successfully implement it while keeping the trust of residents intact.

What Is an HOA Special Assessment?

An HOA special assessment is a one-time payment charged to homeowners when the regular HOA fees and reserve accounts cannot cover unexpected expenses, extensive repairs, or urgent projects.

Key Aspects of a Special Assessment:

- Charged in addition to normal HOA fees.

- Typically associated with particular expenses such as a new roof, storm damage repairs, or road upgrades.

- Must be approved by the board of directors and, in most states, voted on by the homeowners.

- Can be one-time or distributed over installments.

Example: When an HOA has a $50,000 bill to repair the roof but only has $20,000 in reserves, a special assessment can require every homeowner to pay their portion of the $30,000 deficit.

To understand how reserves are managed effectively, see our guide on best practices for managing HOA reserve funds.

Why Do HOAs Levy Special Assessments?

Special assessments occur when budgets are inadequate. Typical causes include:

- Emergency Repairs: storm damage, plumbing breakdowns, or fire mitigation.

- Major Capital Improvements: elevator upgrades, road resurfacing, or replacing a pool.

- Reserve Fund Shortfalls: when savings are not enough.

- Legal Expenses: surprise lawsuits or compliance fees.

- Rising Costs: inflation or shortages affecting construction.

If resident satisfaction is a concern, check out our blog on resolving issues and retaining residents with better property management practices.

HOA Special Assessments vs. HOA Dues: What’s the Difference?

HOA dues are ongoing monthly or quarterly fees that cover regular expenses such as landscaping, utilities, personnel, and general maintenance. On the other hand, HOA special assessments are one-time payments for unforeseen or extraordinary expenses not covered by dues or reserves.

Fact: About 70% of HOAs have a reserve fund, but almost half say their funds are not adequately funded, because of which the need for special assessments arises when crises hit.

For more on financial strategies, read our guide on organizing your finances with the ideal property management chart of accounts.

Who Decides on a Special Assessment?

Usually, the HOA board of directors presents the assessment. Depending on local ordinances and governing documents:

- Small assessments can be approved by some boards directly.

- Bigger assessments usually must have a majority of homeowners’ approval.

- State laws can cap how much can be charged without homeowner approval.

For managers starting out, our blueprint to success for becoming a property manager covers how governance and decision-making typically work in HOAs.

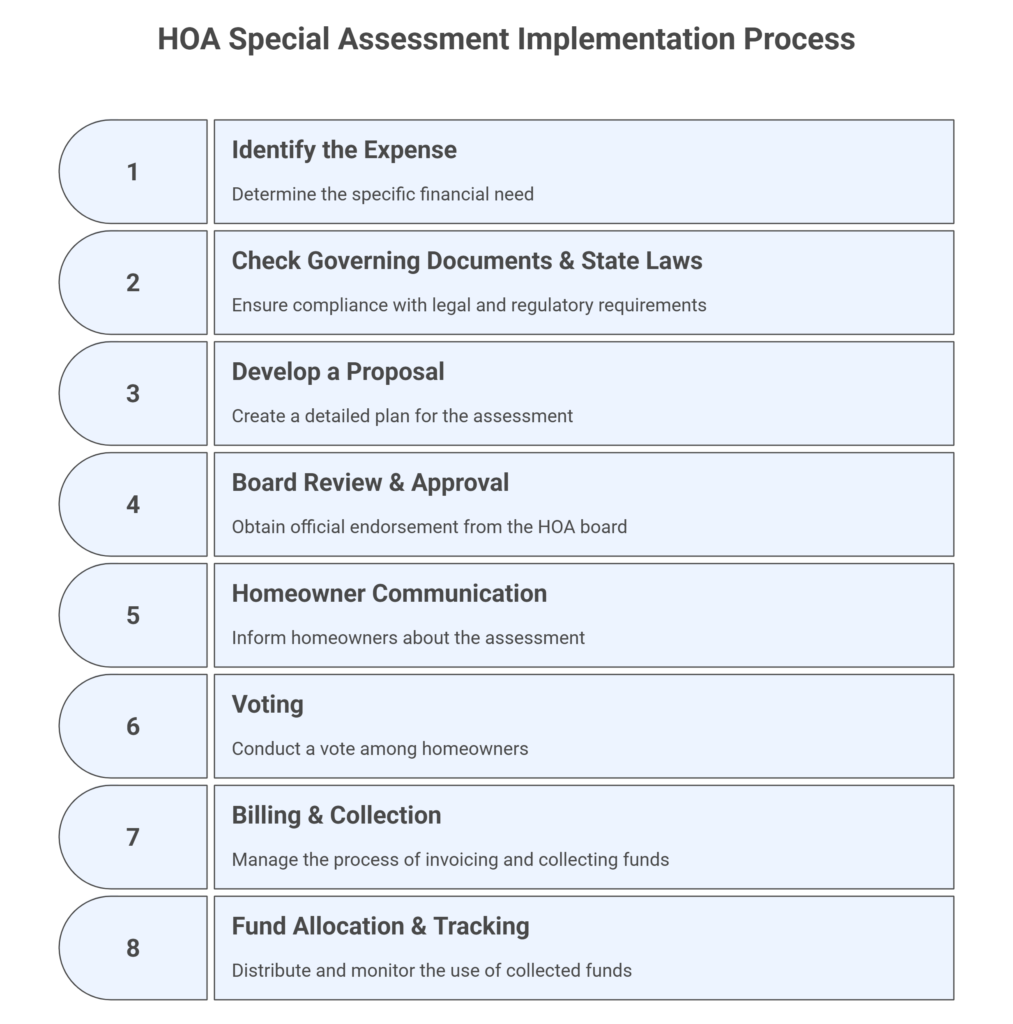

Step-by-Step: How to Implement an HOA Special Assessment

Identify the Expense

- Verify the deficit or surprise repair.

- Get cost quotes and backup information.

Check Governing Documents & State Laws

- Consult the HOA bylaws for approval clauses.

- Check any state limits or notice periods.

Develop a Proposal

- Outline the cost, use, and homeowner effect.

- Offer several options (e.g., lump sum vs installment).

Board Review & Approval

- Submit proposal to the board for initial approval.

Homeowner Communication

- Send clear notices indicating the reasons for the assessment.

- Provide Q&A sessions, FAQs, and transparent breakdowns.

Voting (if necessary)

- Conduct the vote as per the governing rules.

- Document results for compliance with the law.

Billing & Collection

- Issue invoices with clear timeframes.

- Provide installment plans to lower the burden on homeowners.

Fund Allocation & Tracking

- Make deposits to a designated account.

- Track expenses transparently and share updates with homeowners.

Want to improve process efficiency? Explore how advanced property management software streamlines complex workflows.

How to Communicate a Special Assessment Without Conflict

This is where most community managers get it wrong. Homeowners don’t like surprises, so a communication strategy makes all the difference.

Best Practices:

- Be Transparent: Share the exact cost and explain why reserves wouldn’t cover it.

- Use Multiple Channels: Emails, meetings, community portals, even text messages.

- Empathize: Understand the financial burden and offer flexible options.

- Provide Context: Compare assessment expense with property value protection.

Example: If today replacing the roof costs $1,200 per home, it might inflate to $5,000+ to repair the same roof in the future.

If communication is a weak spot, you might benefit from our guide on smart solutions for efficient tenant communication.

Can Homeowners Refuse to Pay an HOA Special Assessment?

No. Homeowners are legally obliged to pay the approved HOA special assessment. Non-payment can lead to late charges, liens, or even foreclosure, as dictated by state law and HOA regulations.

That’s why transparent communication, installment plans, and advance disclosure are essential to reduce conflict.

See how property managers balance compliance and trust with best practices for managing a property management trust account.

How to Avoid HOA Special Assessments

Whereas it may not always be possible to avoid assessments, preemptive planning and management can minimize the risk:

- Keep Adequate Reserves: Regular reserve studies are essential.

- Budget Conservatively: Budget for inflation and increasing expenses.

- Plan Preventive Maintenance: Minor repairs today prevent larger expenditures later.

- Insurance Coverage: Renew policies each year for gaps.

- Transparent Financial Reporting: Establish homeowner trust before emergencies.

Final Thoughts

Your role as a community manager is to create and maintain a perfect balance between the financial stability of the HOA homeowner trust.

Special assessments might be unpopular, but with open bookkeeping, compassion, and policy, they can protect the community without long-term fallout.

Pro tip: The best strategy isn’t necessarily knowing how to implement a special assessment; it is essential to understand how to build solid budgeting routines and minimize the need in the first place.

Table of Contents

Stay Updated

Subscribe to get the latest news, industry trends, blog posts, and updates...