Why do most property management startups fail? Here’s a hard truth: most new property management companies don’t fail because of a lack of demand; they fail because they start without a clear plan. Jumping in without a business plan means you’ll likely struggle with:

- No clarity on who your clients are

- Confusion over pricing and services

- Cash flow challenges in the first year

- Difficulty scaling or competing with established firms

A property management business plan is your roadmap to survival. It tells you: What services will you provide? How will you differentiate? How will you gain and retain customers?

In this blog, we’re going to guide you through a step-by-step template to develop a property management business plan that is functional, investor-worthy, and scalable.

Whether you’re dealing with a handful of rental properties or looking to start a full-fledged property management company, this guide provides the blueprint you need.

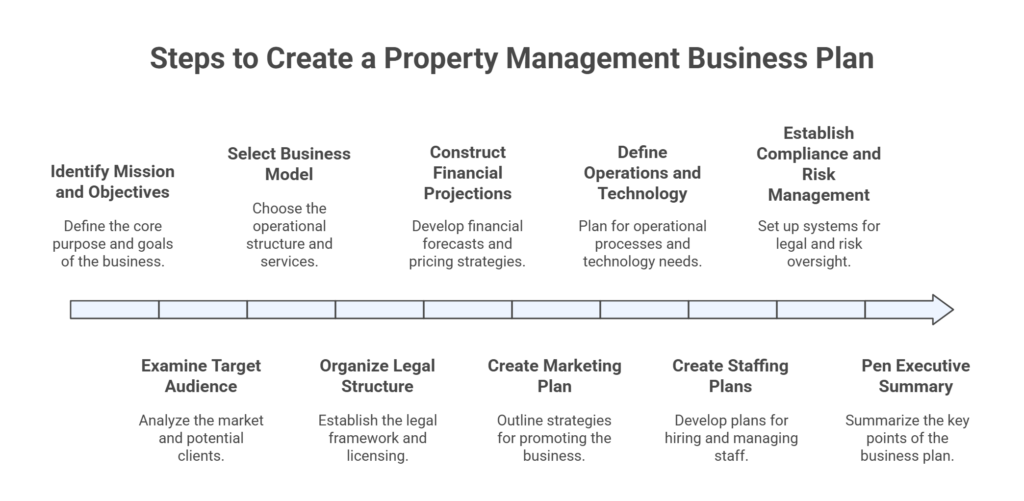

Steps to Create A Property Management Business Plan

You can follow these steps to create a property management business plan:

- Identify your mission, vision, and objectives

- Examine your target audience and industry players

- Select your business model and offerings

- Organize your legal structure and licensing

- Construct your financial projections and pricing scheme

- Create your marketing and sales plan

- Define operations and technology requirements

- Create staffing and hiring plans

- Establish compliance and risk management

- Pen down your executive summary

(All the above steps are explained in detail below)

What Is a Property Management Business Plan?

A property management business plan is a professional document that describes your strategy to expand and run your property management business. It serves as:

- A roadmap – directing your daily decisions

- A pitch deck – handy when looking for investors or seeking a loan

- A growth strategy – assisting you to expand and track progress

As per the Small Business Administration (SBA), those businesses with a formal business plan grow 30% more than those that don’t have one. That’s a lot in the real estate business, which is highly competitive.

For those still exploring the basics, our blog on laying the foundation for starting a property management business breaks down the essentials before you dive into planning.

Why Do You Need a Property Management Business Plan?

1. To Stand Out in a Crowded Market

The U.S. has over 300,000 property management companies (IBISWorld, 2024). Without a unique value proposition, you’ll blend in with the crowd. If you’re not sure what differentiates successful firms, see our guide on understanding the property management business model.

2. To Attract Clients and Investors

Owners and investors want to trust that you’re organized, reliable, and capable of managing their assets. A professional business plan shows them you’re serious.

3. To Avoid Costly Mistakes

Without forecasting expenses, pricing, and growth, it’s easy to mismanage cash flow, one of the biggest reasons small businesses fail. For financial structure, check out our resource on organizing your property management chart of accounts.

4. To Scale Efficiently

With a plan in writing, you can add staff, technology, and properties methodically, rather than randomly.

Step 1: Define Your Mission, Vision, and Goals

Ask yourself:

- Why am I launching this property management business?

- What am I solving for property owners and renters?

- What’s my 5-year vision?

Example:

- Mission: “To make rental ownership easier through transparent, technology-driven property management services.”

- Vision: “To be the most trusted property management firm for mid-sized landlords in Chicago by 2028.”

- Goal: “Manage 200 units in 24 months with a 90% tenant satisfaction rating.”

For inspiration, see our blog on essential steps and requirements for becoming a property manager.

Step 2: Research Your Target Market and Competitors

You should establish your market dynamics before you determine pricing or services.

Key Research Areas:

- Local demand: How many rental properties are in your city?

- Target clients: Individual landlords, real estate investors, HOAs, or commercial property owners?

- Competitors: Who are the top 5 property managers in your area? What do they charge?

Example:

If you’re in Austin, TX, with a booming rental market, competition will be high. You’ll need to highlight specialization, maybe short-term rentals or student housing.

Related Reading: Learn how strong service helps in retaining residents and resolving issues.

Step 3: Choose Your Business Model and Services

Your business plan must clearly state what services you’ll offer.

Common Property Management Services:

- Tenant screening and leasing

- Rent collection and accounting

- Maintenance coordination

- Marketing vacant units

- Eviction management

- HOA or community association management

Want to go deeper? Our blog on the importance of efficient rental leasing explains how leasing efficiency impacts profitability.

Step 4: Structure Your Legal Entity and Licensing

You need to decide on your business structure:

- LLC: popular for liability protection

- S-Corp: tax benefits for small teams

- C-Corp: superior for raising outside money

Also, check state licensing regulations:

- Certain states (such as Nevada, Oregon, and South Carolina) have a real estate broker’s license requirement.

- Others might require only a property management license.

For more details, see our guide on property management requirements by state.

Step 5: Build Financial Projections and Pricing

This is the section investors examine first.

Important Financial Aspects:

- Startup expenses (licenses, software, office, marketing)

- Monthly costs (payroll, insurance, tech subscriptions)

- Revenue model:

- Flat monthly rate per unit

- Proportion of monthly rent (usually 8–12%)

- Leasing or initial setup fees

Sample estimate for 50 units at $1,500 rent:

- 10% management fee → $150 per unit

- $150 × 50 units = $7,500 per month revenue

For accuracy, learn how to manage bank accounts for property management and track profitability.

Step 6: Create Your Marketing and Sales Strategy

Even the best property manager can’t expand without clients.

What to include in your plan:

- Branding: Company name, logo, and positioning

- Website: Professional, mobile-friendly, SEO-optimized

- Digital Marketing: Google Ads, social media, email campaigns

- Local Outreach: Networking with realtors, investor clubs, and HOA boards

Use digital campaigns to fill vacancies. See our blog on creative rental property marketing ideas for actionable tactics.

Step 7: Outline Operations and Technology Needs

Property management is operations-intensive. Technology saves time and minimizes mistakes.

Essential tools:

- Property management software (accounting, leasing, tenant portal)

- Maintenance request system

- Online rent collection platform

- CRM for client communication

You can explore how generative AI is helpful for property management software to see where the industry is headed.

Step 8: Develop Staffing and Hiring Plans

Your business plan should detail when and how you’ll add staff.

Key Roles:

- Property manager (you, initially)

- Leasing agent

- Maintenance coordinator

- Bookkeeper/accountant

- Marketing manager

Scaling example:

- First 50 units: solo + part-time bookkeeper

- 50–200 units: hire maintenance and leasing support

- 200+ units: build a full in-house team

For staffing inspiration, read about skills and qualifications for entry-level property management jobs.

Step 9: Set Up Compliance and Risk Management

Property management involves legal risks.

- Keep current on fair housing laws

- Have clear contracts with owners and tenants

- Have sufficient insurance (general liability, errors & omissions)

- Take data security precautions for tenant/owner data

Learn about credibility in compliance with best practices for managing a property management trust account.

Step 10: Write Your Executive Summary

Although it comes first in your plan, write it last. The executive summary is a one-page overview of everything:

- Mission & vision

- Services provided

- Market opportunity

- Financial projections

- Growth roadmap

Consider it the elevator pitch for your business.

Sample Outline for Property Management Business Plan

Here’s a basic outline you can use:

- Executive Summary

- Company Overview

- Mission, Vision & Goals

- Market Analysis

- Competitor Analysis

- Services & Business Model

- Legal & Licensing Structure

- Financial Plan & Projections

- Marketing & Sales Plan

- Operations & Technology

- Staffing & Hiring

- Risk Management & Compliance

Common Mistakes to Avoid

Being too generic: “We manage properties” won’t work. You have to specify your niche. For instance, check out our post on best practices for single-family property management.

Overestimating revenue: Project lower occupancy and increased costs in your projections.

Disregarding technology: Manual work doesn’t scale. Look into streamlining property management with modern software.

Bypassing compliance: Fines from the law can drown your business prematurely.

FAQs About Property Management Business Plans

Startup costs range from $2,000 to $10,000, depending on licensing, office establishment, and software subscription.

In most states, yes. Some require a real estate broker’s license, others require a property management license. Always refer to local laws.

Primarily through percentage fees (8–12% of rent received), as well as leasing/setup fees and markups on maintenance.

Final Thoughts

Writing a property management business plan is not just a courtesy, it’s the key to your company’s success. Having a solid plan in place will:

- Prevent expensive errors

- Bring in more clients and investors

- Grow more efficiently and effectively

Whether you’re just beginning or optimizing your growth strategy, the time you invest to develop a solid business plan today will prevent years of trial and error tomorrow.

Next up: Explore our guide on navigating legal and operational requirements for property management startups to ensure your launch is compliant from day one.

Table of Contents

Stay Updated

Subscribe to get the latest news, industry trends, blog posts, and updates...