After managing over 1,000 rental units across 12 years, I’ve discovered that property management bookkeeping is the make-or-break factor for successful property management companies. While most managers treat bookkeeping as a necessary evil, smart operators use it as their secret weapon for scaling and maximizing profitability.

The numbers don’t lie: Property management companies with sophisticated bookkeeping for property management systems generate 34% higher profit margins and experience 67% fewer compliance issues than those using basic accounting methods.

Want to transform your bookkeeping from a burden into a competitive advantage? Here are the 15 property management bookkeeping best practices that maximize your profits.

1. Implement Segregated Trust Accounting (Not Just Separate Accounts)

Most property managers think having separate bank accounts is enough. It’s not. You need a hierarchical trust structure that protects you legally and provides crystal-clear financial visibility.

Set up these specific accounts:

- Master Operating Trust for rent collections

- Security Deposit Escrow (state-mandated)

- Capital Improvement Reserve for major projects

- Emergency Repair Fund for urgent situations

- Owner Distribution Holding for monthly payouts

Why this matters: One commingling mistake can cost you your license. Proper segregation protects you legally while building owner trust through transparent financial reporting. For detailed guidance on trust account management, check out our comprehensive guide on managing property management trust accounts.

2. Create Property-Specific Chart of Accounts

Generic accounting charts create chaos in property management. Develop a standardized system that captures rental property’s unique financial categories.

Essential revenue categories:

- Base rent income

- Late fees and penalties

- Application and screening fees

- Pet fees and deposits

- Parking and storage fees

- Utility reimbursements

Critical expense classifications:

- Routine maintenance vs. capital improvements

- Vacancy preparation costs

- Marketing and leasing expenses

- Professional services fees

- Insurance and property taxes

Pro tip: Use consistent numbering across all properties to enable portfolio-wide analysis and reporting. Need help setting up your chart of accounts? Our detailed guide on organizing your property management chart of accounts provides step-by-step instructions.

3. Automate Rent Collection and Late Fee Processing

Manual rent collection costs you money and creates errors. Automated systems reduce collection time by 80% while improving cash flow.

Implement these automated features:

- ACH payment processing

- Automatic late fee application

- Payment reminder sequences

- Delinquency escalation workflows

- Real-time payment tracking

The result: Top-performing property managers collect 87% of rent within 5 days of the due date using automated systems. To learn more about setting up automated rent collection, read our comprehensive guide on how to automate rent collection and eliminate late payments.

4. Master Weekly Reconciliation Protocols

Monthly reconciliation isn’t enough for property management. The high volume of transactions requires more frequent monitoring to catch discrepancies early.

Follow this reconciliation schedule:

- Daily: Verify rent deposits and major expense payments

- Weekly: Reconcile trust accounts and owner statements

- Monthly: Complete full bank reconciliation and variance analysis

- Quarterly: Conduct comprehensive audit of all financial statements

Why weekly matters: Small discrepancies compound quickly in property management. Weekly reconciliation prevents $5 errors from becoming $500 problems.

5. Implement Dynamic Expense Approval Workflows

Balance speed with financial control through tiered approval systems that keep operations moving while protecting profitability.

Optimal approval structure:

- Under $100: Auto-approve routine maintenance

- $100-$500: Property manager approval required

- $500-$2,000: Owner approval with 24-hour response window

- Over $2,000: Owner approval with detailed justification

The benefit: Reduces approval delays by 60% while maintaining financial oversight.

6. Track Profitability at the Property Level

Portfolio-wide profitability masks problem properties. Analyze each property individually to identify your stars and your drains.

Monitor these key metrics per property:

- Net Operating Income (NOI) per unit

- Cost per maintenance request

- Vacancy rates and turnover expenses

- Revenue per square foot

- Owner satisfaction scores

Action step: Properties with NOI below $200 per unit monthly need immediate attention or should be considered for termination. For more insights on tracking property performance, explore our property management KPIs guide.

7. Use Predictive Maintenance Budgeting

Historical data reveals maintenance patterns that help you budget accurately and avoid surprise expenses.

Budget by building characteristics:

- Pre-1980 properties: 15-20% higher maintenance costs

- Properties with original HVAC systems: 25% higher utility expenses

- Multi-family buildings: 30% higher common area maintenance

Track maintenance patterns:

- Seasonal maintenance cycles

- Preventive vs. reactive maintenance ratios

- Vendor performance and cost trends

Learn more about reducing maintenance expenses in our detailed guide on proven ways to lower property maintenance costs.

8. Create Value-Added Owner Reporting

Basic profit and loss statements aren’t enough. Provide insights that help owners make better investment decisions and increase their satisfaction with your services.

Include these advanced reports:

- Market comparison showing property performance vs. local averages

- Improvement ROI analysis for potential upgrades

- Tax optimization summaries highlighting deduction opportunities

- Disposition analysis showing optimal timing for property sales

The payoff: Detailed reporting increases owner retention rates by 23% and generates more referrals. Our owner portal feature makes it easy to provide owners with real-time access to these valuable reports.

9. Establish Vendor Financial Controls

Poor vendor management destroys profitability. Implement systems that control costs while maintaining service quality.

Essential vendor controls:

- Performance metric tracking

- Volume discount negotiations

- Licensing and insurance verification

- Automated payment processing

- Detailed cost history maintenance

Benchmark: Top property managers reduce vendor costs by 15-20% through systematic vendor management.

10. Master Multi-State Compliance Automation

Managing properties across multiple states creates exponential compliance complexity. Your property management bookkeeping software must handle this automatically.

Automated compliance features needed:

- State-specific security deposit requirements

- Local tax calculations and remittances

- Required regulatory report generation

- License renewal deadline tracking

- Audit trail maintenance for inspections

Risk mitigation: Compliance violations average $12,000 per incident. Automation prevents costly mistakes.

11. Implement AI-Powered Expense Categorization

Modern property management bookkeeping software uses artificial intelligence to categorize expenses automatically, reducing manual entry time by 70%.

Look for AI features that:

- Learn your categorization preferences

- Flag unusual transactions for review

- Suggest vendor optimization opportunities

- Predict maintenance cost trends

- Identify potential fraud patterns

Time savings: AI categorization reduces bookkeeping time from 20 hours per week to 6 hours per week for a 200-unit portfolio. Discover more about how technology can streamline your operations in our guide on property management tasks you should automate today.

12. Create Real-Time Financial Dashboards

Replace static monthly reports with dynamic dashboards that provide instant insights into your business performance.

Essential dashboard metrics:

- Portfolio performance updated daily

- Cash flow trends with predictive modeling

- Maintenance costs by property and category

- Owner satisfaction scores tied to financial performance

- Compliance status indicators

Decision advantage: Real-time data enables faster response to problems and opportunities.

13. Optimize Cash Flow Forecasting

Don’t just track cash flow, predict and optimize it. Maintain a 12-month forecasting model that accounts for seasonal patterns and major expenses.

Include these forecasting elements:

- Seasonal vacancy patterns

- Scheduled maintenance cycles

- Capital improvement projects

- Market rent adjustment timing

- Owner distribution schedules

Cash flow target: Maintain 45-60 days of operating expenses in reserve for optimal financial stability.

14. Integrate Automated Tax Preparation

The best bookkeeping for property management systems integrate directly with tax software, automatically generating required forms and schedules.

Automated tax features:

- Schedule E rental income reports

- Depreciation schedule calculations

- 1099 contractor payment tracking

- State and local tax filing preparation

- Owner K-1 statements for partnerships

Efficiency gain: Automated tax preparation reduces year-end accounting work by 60%. For property managers using Xero, our Propertese-Xero integration seamlessly syncs your financial data for even more streamlined tax preparation.

15. Build Scalable Onboarding Systems

As you grow, onboarding new properties must be seamless. Standardized processes ensure consistency and reduce errors.

Automated onboarding includes:

- New property account creation

- Existing lease data importation

- Automated rent collection setup

- Initial financial report generation

- Vendor relationship establishment

Scaling benefit: Systematic onboarding reduces new property setup time from 8 hours to 2 hours. Learn more about efficient portfolio management strategies that support sustainable growth.

Key Performance Benchmarks for Property Management Bookkeeping

Track these advanced metrics to measure your bookkeeping system’s effectiveness:

- Portfolio Efficiency Ratio: Total revenue divided by total operational hours. Top performers achieve $150+ per operational hour.

- Owner Retention Rate: Percentage of owners who renew management agreements annually. Industry leaders maintain 95%+ retention rates.

- Collection Efficiency: Percentage of total rent collected within 5 days of due date. Target 85%+ for optimal cash flow.

- Maintenance Cost Per Unit: Monthly maintenance expenses per unit. Efficient operations average $35-45 per unit monthly.

- Profit Margin Per Property: Net income as percentage of gross rent. Well-managed properties generate 8-12% net margins.

Frequently Asked Questions

Property management bookkeeping involves managing multiple owner accounts simultaneously, requiring strict trust account segregation, property-level financial reporting, and compliance with state-specific regulations. Unlike regular businesses, property managers operate dozens of separate financial entities under one management umbrella.

Most property managers use cash-basis accounting combined with trust accounting principles. This approach provides clear cash flow visibility while maintaining proper segregation of owner funds. However, larger portfolios may benefit from accrual accounting for more accurate financial reporting. For more details on property management accounting methods, see our comprehensive guide on property management accounting.

The most costly mistakes include commingling owner funds, using generic accounting software, inadequate expense categorization, and infrequent reconciliation. These errors lead to compliance violations, owner dissatisfaction, and financial losses. For a detailed comparison of software solutions, read our analysis of spreadsheets vs. property management software.

Trust accounts should be reconciled weekly at minimum, with daily monitoring of large transactions. The high volume of transactions in property management requires more frequent reconciliation than typical businesses to catch discrepancies early.

Provide monthly profit and loss statements, cash flow summaries, maintenance reports, and annual tax documents. Advanced owners also appreciate market comparison reports and ROI analysis for potential improvements.

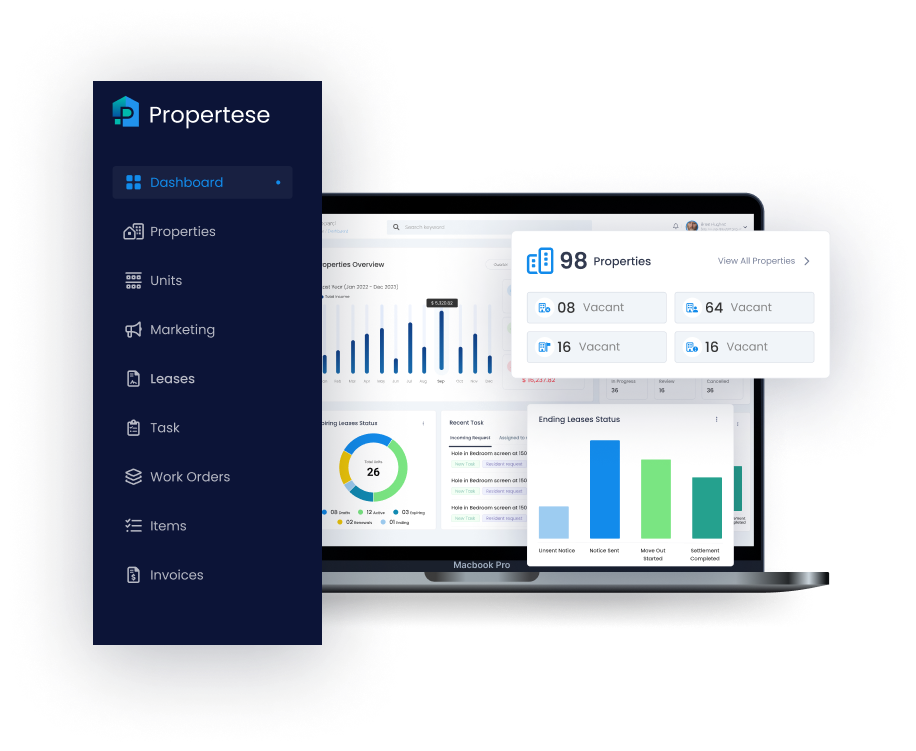

Why Smart Property Managers Choose Propertese for Financial Excellence

The Problem: Most property managers are drowning in financial chaos. They’re using 3-4 different systems that don’t talk to each other, spending 20+ hours weekly on manual bookkeeping, and constantly worried about compliance violations that could destroy their business overnight.

The Cost of Inaction: Property management companies using fragmented systems lose an average of $47,000 annually through inefficiencies, compliance penalties, and missed opportunities. Even worse? 23% of property managers have faced serious legal issues due to trust account violations.

The Propertese Solution: We built the only property management bookkeeping software that solves ALL your financial challenges in one unified platform, without the complexity that bogs down other systems. Get a demo today.

Table of Contents

Stay Updated

Subscribe to get the latest news, industry trends, blog posts, and updates...