Yes, landlords can legally accept credit card payments for rent in all 50 US states. Over 70% of tenants now prefer digital payment options, and properties accepting credit cards report 85% fewer late payments with improved cash flow management.

Credit Card Rent Payments by the Numbers

Essential statistics for property managers and landlords

Can You Accept Credit Card Payments for Rent as a Landlord?

Yes, there are no legal restrictions preventing landlords from accepting credit card payments for rent anywhere in the United States.

What you need to get started:

- Merchant account or payment processing service

- Property management software with integrated payments

- PCI compliance for security standards

- Clear fee disclosure in lease agreements

Timeline: Most landlords can start accepting credit cards within 7-14 days of setup.

How Much Does It Cost to Accept Credit Card Rent Payments?

Credit card processing typically costs 2.4% to 2.9% plus $0.30 per transaction.

Cost breakdown for common rent amounts:

- $1,500 rent: $36.80 – $44.80 in processing fees

- $2,000 rent: $48.30 – $58.30 in processing fees

- $2,500 rent: $60.30 – $72.80 in processing fees

Who pays the fees:

- 83% of landlords pass processing fees to tenants

- 12% of landlords absorb costs as competitive advantage

- 5% of landlords split costs with tenants

Credit Card Processing Fees Calculator

Calculate exact processing costs for your rental properties

Do Tenants Actually Want to Pay Rent with Credit Cards?

Yes, tenant demand is driving this trend with over 5,000 monthly searches for “can you pay rent with credit card.”

Why tenants prefer credit card payments:

- Earn 1.5-2% cashback on their largest monthly expense

- Build credit history with consistent on-time payments

- Autopay convenience prevents accidental late fees

- Financial flexibility during tight cash flow periods

- Digital receipts for easy record keeping

Search volume data:

- “Can you pay rent with credit card”: 5,000+ monthly searches

- “How to pay rent with credit card”: 1,700+ monthly searches

- “Should I pay rent with credit card”: 600+ monthly searches

What Are the Benefits of Accepting Credit Card Rent Payments?

The top benefit is an 85% reduction in late payments, with additional advantages including improved cash flow and tenant satisfaction.

Reduce Late Payments by 85%

Credit cards solve the most common causes of late rent:

- “I forgot to pay” → Autopay eliminates missed payments

- “I’m short on cash” → Credit provides temporary financial buffer

- “Check got lost in mail” → Instant digital processing

- “Bank was closed” → 24/7 payment availability

How Credit Cards Solve Late Payment Problems

Transform common rent collection challenges into automated solutions

Attract Higher Quality Tenants

Properties accepting credit cards appeal to:

- Tech professionals earning $75,000+ annually

- Millennials and Gen Z who prefer digital solutions

- Credit optimizers who responsibly manage rewards

- Busy professionals who value convenience

Improve Cash Flow Predictability

Unlike checks that can bounce:

- Pre-authorized payments guarantee available funds

- Consistent deposit timeline of 2-3 business days

- Reduced collection efforts and associated costs

- Automated processing eliminates manual handling

Save Administrative Time

Property managers report saving 15+ hours monthly through:

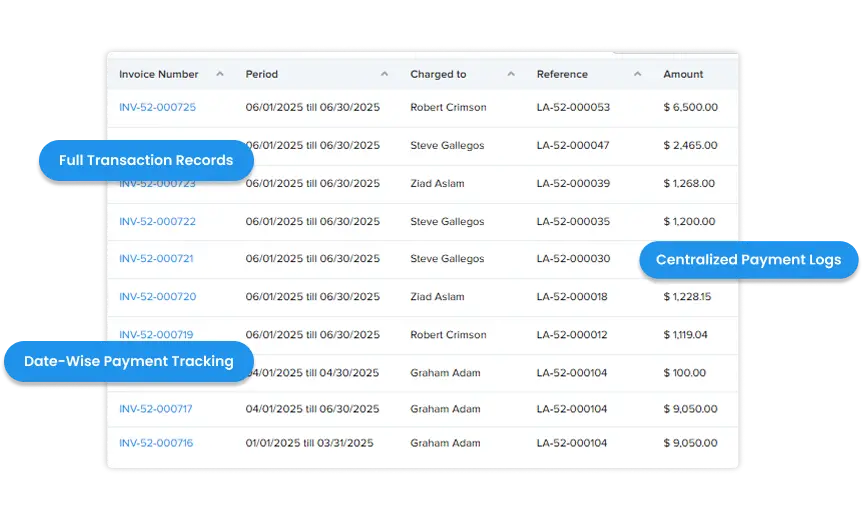

- Automated payment processing and reconciliation

- Digital receipt generation and delivery

- Real-time payment tracking and reporting

- Reduced late payment follow-up calls and notices

What Are the Risks of Accepting Credit Card Rent Payments?

The main risks are processing fees (2-3% of rent) and potential chargebacks, though both are manageable with proper systems.

Processing Fee Impact

- Small portfolios (1-5 units): $200-500 monthly in fees

- Medium portfolios (6-25 units): $1,000-3,000 monthly in fees

- Large portfolios (25+ units): $3,000+ monthly in fees

Chargeback Risk (Low but Real)

- Frequency: 0.1-0.3% of all transactions

- Common causes: Tenant disputes service quality or unauthorized charges

- Prevention: Clear lease terms and detailed payment records

- Resolution: Most resolved within 30-60 days with proper documentation

Processing Delays

- Credit cards: 2-3 business days to receive funds

- ACH transfers: 1-2 business days

- Checks: Immediate deposit but bounce risk

- Mitigation: Adjust cash flow planning and maintain reserves

How Do You Set Up Credit Card Payments for Rent Collection?

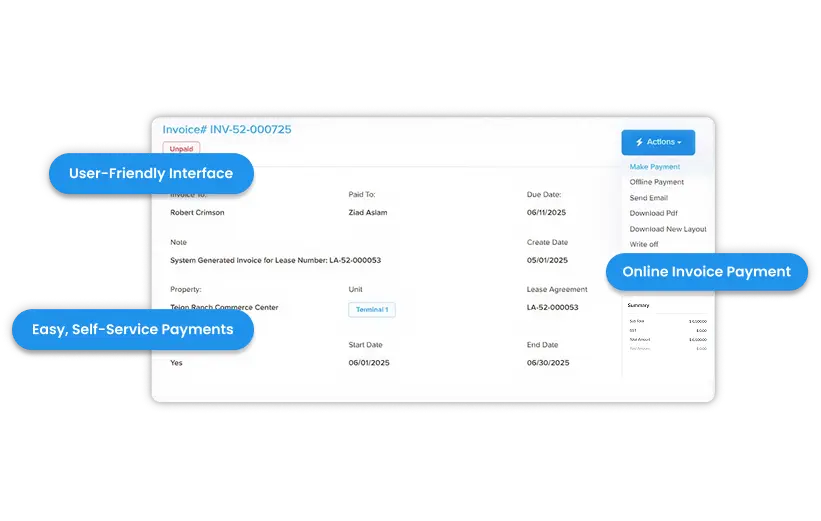

The fastest way is by using property management software like Propertese, which offers online rent payments & collections with integrated payment processing.

Step 1: Choose Your Payment Solution

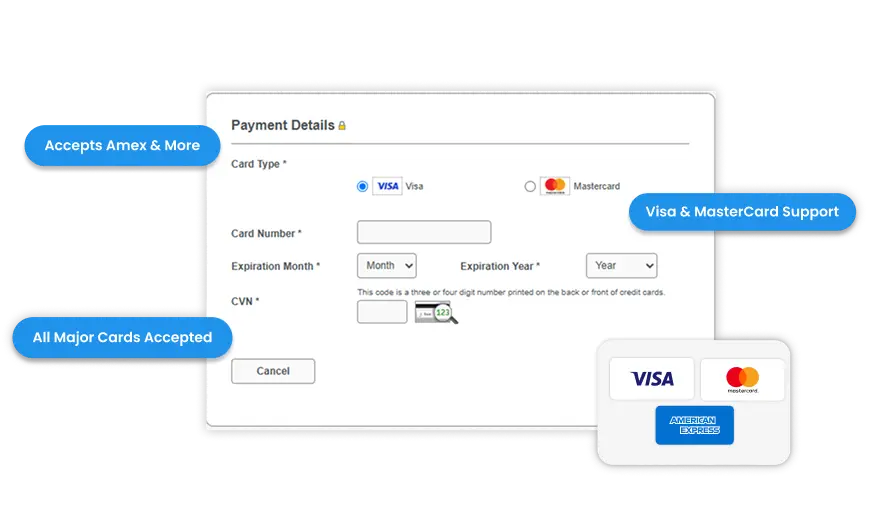

Propertese offers the most comprehensive solution:

- All major credit cards accepted (Visa, MasterCard, American Express, Discover)

- PCI compliant with CyberSource integration for security

- Purpose-built for real estate with specialized tools

- Cloud-based access from any device, anywhere

Step 2: Configure Payment Settings

Setup includes:

- Payment method options and fee structures

- Automated payment notifications and receipts

- Tenant portal integration for self-service

- Real-time payment tracking and reporting

Step 3: Update Legal Documentation

Lease agreement updates:

- Accepted payment methods disclosure

- Processing fee amounts and calculation

- Payment processing timelines

- Failed payment and chargeback procedures

Step 4: Train Tenants and Staff

Implementation support:

- Tenant portal setup instructions

- Payment processing timeline education

- Customer support contact information

- Troubleshooting common issues

Should You Pass Credit Card Fees to Tenants?

Yes, 83% of landlords pass processing fees to tenants, which is legal in all states with proper disclosure.

Legal Requirements by State

- All 50 states: Allow passing credit card fees to tenants

- California: Requires written fee disclosure

- New York: Fees cannot exceed actual processing costs

- Texas: Standard disclosure requirements apply

- Best practice: Always disclose fees clearly regardless of state

State Credit Card Fee Regulations

Legal requirements for charging tenants credit card processing fees

With varying disclosure requirements

Fee Structure Options

- Percentage-based: 2.95% of rent amount

- Flat fee: $25-50 monthly regardless of rent

- Hybrid: Small percentage plus flat fee

- Exact cost: Pass through exact processing fee

Tenant Acceptance Strategies

- Provide fee-free alternatives (ACH/bank transfer)

- Highlight convenience benefits of credit card payments

- Show reward earning potential that often exceeds fees

- Offer payment method choice rather than mandating credit cards

What’s the Best Property Management Software for Credit Card Payments?

Propertese provides the most comprehensive rent collection platform with integrated credit card processing designed specifically for property management.

Why Propertese Leads the Market

Complete Rent Collection Platform:

- Centralizes payment processing, tenant communications, and financial reconciliation

- Purpose-built for real estate with specialized property management tools

- Handles residential, commercial, and HOA properties from 10 to 10,000+ units

Advanced Security Features:

- PCI DSS compliant with bank-grade encryption

- CyberSource integration for enterprise-level transaction security

- Encrypted payment processing protecting sensitive tenant data

- Fraud monitoring and real-time transaction alerts

Automated Payment Operations:

- Multiple payment methods including all major credit cards

- Automated payment notifications and instant receipts

- Real-time payment tracking with immediate status updates

- Failed payment retry and partial payment management

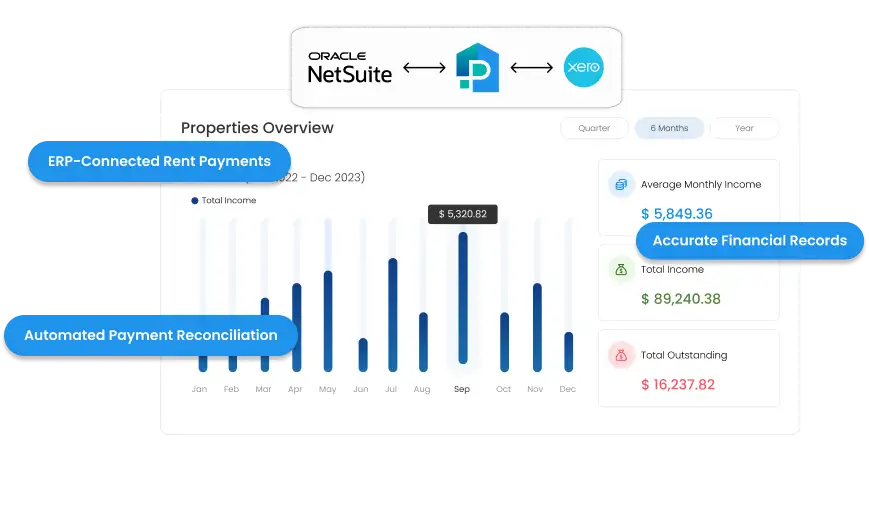

Financial Integration:

- NetSuite and Xero synchronization for seamless accounting

- Automated reconciliation eliminating manual data entry

- Comprehensive payment history with complete audit trails

- Real-time financial reporting and cash flow analytics

Tenant Experience:

- Embedded tenant portal for self-service payments

- Mobile-optimized payment interface

- Contactless payment options for modern convenience

- Payment plan management for flexible arrangements

Proven Results

- 85% reduction in late payments across customer base

- 15+ hours saved monthly on payment processing

- Improved tenant satisfaction through convenient payment options

- Enhanced cash flow with predictable payment timing

How Long Does Credit Card Processing Take for Rent Payments?

Credit card rent payments typically process within 2-3 business days, with funds deposited directly to your business account.

Processing timeline breakdown:

- Payment submitted: Immediate confirmation to tenant

- Authorization: Within minutes of submission

- Settlement: 2-3 business days for fund transfer

- Availability: Funds available in your account after settlement

Compared to other payment methods:

- ACH/Bank transfer: 1-2 business days

- Checks: Immediate deposit but 3-5 days to clear

- Wire transfers: Same day (expensive for tenants)

- Cash: Immediate but security risks

Payment Methods Comparison

Compare all available rent payment options for landlords

| Payment Method | Processing Time | Fees | Tenant Appeal | Admin Work | Security |

|---|---|---|---|---|---|

| Credit Cards | 2-3 days | 2.9% |

|

|

|

| ACH/Bank Transfer | 1-2 days | $0.50-1.50 |

|

|

|

| Checks | Immediate | None |

|

|

|

| Money Orders | Immediate | None |

|

|

|

| Cash | Immediate | None |

|

|

|

- 85% reduction in late payments

- Automated processing saves time

- High tenant satisfaction

- 24/7 payment availability

- Built-in fraud protection

- Digital audit trails

- Attracts quality tenants

- Processing fees (2.9% average)

- 2-3 day processing delay

- Potential chargeback risk

- Requires PCI compliance

- Initial setup complexity

Our Recommendation

Offer multiple payment options with credit cards as the primary method. This maximizes tenant satisfaction while providing the operational benefits of automated processing and reduced late payments.

Is It Worth Accepting Credit Cards for Small Landlords?

Yes, even single-property landlords benefit from credit card acceptance, with break-even typically occurring within 6-12 months.

ROI Analysis by Portfolio Size

Single Property ($2,000 rent):

- Processing fees: $58 monthly ($696 annually)

- Time savings: 3-5 hours monthly ($150-250 value)

- Late payment reduction: 1-2 fewer late fees annually ($200-400 savings)

- Break-even: 8-12 months

Small Portfolio (2-5 properties):

- Processing fees: $120-300 monthly

- Time savings: 8-15 hours monthly ($400-750 value)

- Late payment reduction: 3-8 fewer late fees annually ($600-1,600 savings)

- Break-even: 4-8 months

Medium Portfolio (6-25 properties):

- Processing fees: $350-1,500 monthly

- Time savings: 15-30 hours monthly ($750-1,500 value)

- Administrative efficiency: Significant operational improvements

- Break-even: 2-4 months

ROI Analysis by Portfolio Size

Calculate your return on investment for credit card payment processing

What Questions Should You Ask Tenants About Payment Preferences?

Survey tenants about preferred payment methods during lease signing or renewal to optimize your payment strategy.

Key Survey Questions

Payment Method Preferences:

- “How do you currently prefer to pay monthly bills?”

- “Would you use credit card payments if available?”

- “What payment methods would make rent payment more convenient?”

Fee Sensitivity:

- “Would you pay a small processing fee for credit card convenience?”

- “What’s most important: lowest cost or payment flexibility?”

- “How much would you pay monthly for automated payment convenience?”

Technology Comfort:

- “Do you prefer online payments or traditional methods?”

- “How often do you use mobile apps for financial transactions?”

- “Would you use a tenant portal for rent payments and communication?”

Using Survey Results

- 70%+ prefer digital: Implement credit card processing immediately

- 50-70% prefer digital: Offer multiple options including credit cards

- <50% prefer digital: Start with traditional methods, offer credit cards as option

Tenant Survey Decision Tree

Transform survey results into actionable payment strategy implementation

- How do you currently prefer to pay monthly bills?

- Would you use credit card payments if available?

- What payment methods would make rent payment more convenient?

- Would you pay a small processing fee for credit card convenience?

- What’s most important: lowest cost or payment flexibility?

- How much would you pay monthly for automated payment convenience?

- Do you prefer online payments or traditional methods?

- How often do you use mobile apps for financial transactions?

- Would you use a tenant portal for rent payments and communication?

- Implement credit card processing immediately

- Launch with full digital payment suite

- Prioritize mobile-friendly solutions

- Market convenience and rewards benefits

- Set up automated payment options

- Offer multiple payment options including credit cards

- Maintain traditional methods (checks, ACH)

- Gradual rollout with tenant education

- Provide choice without forcing adoption

- Monitor adoption rates and adjust

- Start with traditional methods as primary

- Offer credit cards as optional alternative

- Focus on education and gradual introduction

- Emphasize security and convenience benefits

- Consider incentives for digital adoption

How Do You Handle Tenants Who Can’t Pay Credit Card Processing Fees?

Offer multiple payment options including fee-free alternatives like ACH transfers or bank drafts.

Alternative Payment Methods

ACH/Bank Transfer:

- Cost: $0.50-1.50 per transaction

- Processing time: 1-2 business days

- Tenant appeal: No fees, automated option

Electronic Check:

- Cost: $1-3 per transaction

- Processing time: 2-3 business days

- Tenant appeal: Familiar process, lower fees

Traditional Options:

- Money orders: Guaranteed funds, no processing fees

- Cashier’s checks: Bank-verified payment

- Personal checks: Lowest cost but bounce risk

Fee Assistance Programs

- First-time tenant incentive: Waive fees for first 3 months

- Long-term tenant discount: Reduced fees after 12 months

- Automatic payment discount: Lower fees for autopay enrollment

- Financial hardship accommodation: Temporary fee waivers

What Happens If a Tenant Disputes a Credit Card Rent Payment?

Chargebacks are rare (0.1-0.3% of transactions) and most are resolved quickly with proper documentation from your property management system.

Chargeback Process Timeline

- Tenant disputes charge: 30-60 days after payment

- Bank investigation: 5-10 business days

- Landlord response required: 7-14 days to provide evidence

- Final decision: 30-45 days from initial dispute

Required Documentation

- Signed lease agreement showing rent amount and due date

- Payment authorization from tenant (portal screenshots)

- Service delivery proof (tenant occupancy records)

- Communication records (emails, notices, portal messages)

Prevention Strategies

- Clear lease terms regarding payment processing

- Detailed payment confirmations with timestamps

- Regular tenant communication about payment policies

- Propertese audit trails providing comprehensive transaction records

Can You Accept Credit Cards for Commercial Property Rent?

Yes, Propertese supports commercial property payment processing with specialized features for complex lease structures and higher payment amounts.

Commercial Property Considerations

Higher Transaction Amounts:

- Processing fees: More significant dollar impact on larger rents

- Fee negotiation: Better rates available for high-volume processing

- Cash flow impact: Larger amounts affected by 2-3 day processing delays

Complex Lease Terms:

- Variable payments: CAM charges, percentage rent, escalations

- Multiple payment streams: Base rent, utilities, maintenance fees

- Partial payments: Ability to handle installment arrangements

Business Tenant Needs:

- Expense tracking: Integration with tenant accounting systems

- Receipt requirements: Detailed documentation for business records

- Payment flexibility: Various methods for different business preferences

Propertese Commercial Features

- Complex billing support for variable commercial leases

- Multiple payment tracking for different charge types

- Enterprise-level security for high-value transactions

- Advanced reporting for commercial property analytics

What’s the Future of Rent Payment Technology?

The rental industry is moving toward fully digital payment ecosystems with AI-powered automation and enhanced security features.

Emerging Trends

Payment Innovation:

- Cryptocurrency acceptance gaining traction in tech markets

- Buy now, pay later options for rent payments

- Voice-activated payments through smart home devices

- Biometric authentication for enhanced security

Artificial Intelligence:

- Predictive payment analytics identifying at-risk tenants

- Automated payment optimization suggesting best methods for each tenant

- Fraud detection improvement through machine learning

- Personalized payment experiences based on tenant behavior

Integration Expansion:

- Smart home connectivity linking payments to property access

- Utility integration for comprehensive housing payment solutions

- Insurance coordination for bundled payment processing

- Maintenance scheduling triggered by payment confirmations

Preparing for the Future

- Choose scalable platforms like Propertese that evolve with technology

- Stay current with payment trends and tenant expectations

- Maintain flexibility in payment method offerings

- Invest in security as digital threats continue evolving

Ready to Start Accepting Credit Card Rent Payments?

Schedule a Propertese demo to see how comprehensive rent collection software can transform your payment processes and improve your bottom line.

Implementation Checklist

- Demo Propertese platform to see features in action

- Calculate potential ROI based on your portfolio size

- Review current lease agreements for payment term updates

- Plan tenant communication strategy for rollout announcement

- Schedule implementation with Propertese specialists

Expected Timeline

- Week 1: Platform demo and contract signing

- Week 2: System configuration and integration

- Week 3: Staff training and documentation updates

- Week 4: Tenant rollout and support

4-Week Implementation Timeline

Credit Card Rent Payment Processing Roadmap

Discovery & Demo

Research, evaluation, and platform selection

System Configuration

Platform setup and payment integration

Training & Documentation

Staff preparation and legal updates

Launch & Support

Tenant rollout and optimization

This guide provides comprehensive information about accepting credit card rent payments. For specific legal or tax advice, consult with qualified professionals in your jurisdiction.

Table of Contents

Stay Updated

Subscribe to get the latest news, industry trends, blog posts, and updates...