If you pay contractors to maintain your properties, you probably need to issue 1099 forms. It’s one of those compliance requirements that seems simple until you’re actually doing it, then the questions start piling up.

In this guide, you’ll learn:

- Which 1099 forms property managers use and when

- Who needs a 1099 (and who doesn’t)

- How to collect W-9s and avoid penalties

- Filing deadlines and electronic requirements

- How to set up a system that works year after year

What Are 1099 Forms and Why Do Property Managers File Them?

The IRS uses 1099 forms to track income paid to non-employees. When you hire a plumber to fix a leak or a landscaper to maintain your property, those payments need to be reported, assuming they meet certain conditions.

For property managers, 1099s serve two purposes: they document deductions for your tax return and fulfill your legal obligation to report contractor payments. The IRS takes information reporting seriously, and penalties for non-compliance add up fast. Having streamlined reporting processes makes compliance much easier.

Recent Changes You Should Know About

The biggest change happened in 2020 when the IRS brought back Form 1099-NEC specifically for contractor payments. Before that, contractor payments went on 1099-MISC. Now they’re separate.

Another major shift: the electronic filing threshold dropped to 10 forms. Starting with the 2024 tax year returns, if you file 10 or more 1099s of any single type, you must file electronically. Understanding these federal reporting requirements helps you stay compliant.

Which 1099 Forms Do Property Managers Actually Use?

Property managers primarily deal with three 1099 forms:

Form 1099-NEC (Nonemployee Compensation)

Use this for: Contractors who perform services—plumbers, electricians, handymen, landscapers, cleaners (if not incorporated), painters, pest control, locksmiths, property photographers, and independent bookkeepers. Managing these maintenance contractors efficiently starts with proper documentation.

The rule: If you paid a non-employee $600 or more during the year for services, you issue a 1099-NEC.

Critical deadline: Both the recipient copy and IRS filing are due January 31. No extensions available.

Form 1099-MISC (Miscellaneous Information)

Use this for: Rent payments to property owners (Box 1) and attorney fees (Box 10).

If you collect rent from tenants and send it to individual property owners (not corporations), you report those payments on 1099-MISC. Managing payments across your portfolio requires tracking these disbursements carefully. Attorney fees require reporting regardless of whether the attorney is incorporated.

Deadline: Recipient copies due January 31, but IRS filing isn’t due until late February (paper) or end of March (electronic) unless reporting attorney fees, which accelerates the deadline to January 31.

Form 1099-INT (Interest Income)

Use this for: Interest paid to tenants on security deposits ($10 or more threshold).

Most property managers don’t deal with this unless they’re in states with strict security deposit interest requirements.

Who Actually Needs to Receive a 1099?

Not every contractor needs a 1099. The rules depend on business structure, payment method, and amount.

The $600 Threshold

If you paid someone $600 or more during the calendar year for services, they might need a 1099. That’s cumulative, six payments of $100 each count.

Business Structure Matters Most

Need 1099s:

- Sole proprietors

- Partnerships

- LLCs taxed as sole proprietorships or partnerships

Don’t need 1099s:

- C-corporations

- S-corporations

- LLCs electing corporate tax status

The critical exception: Attorney fees ALWAYS require a 1099, even if the lawyer is incorporated.

The only way to know for sure is to collect Form W-9 from every contractor before you pay them.

Payment Method Changes Everything

Paid by credit card or payment app? You don’t issue a 1099. The payment processor handles reporting through Form 1099-K.

Paid by check, cash, or ACH transfer? You need to issue a 1099 if the contractor meets the other requirements.

The W-9 Collection Process: Your First Line of Defense

Before you pay any contractor, get a completed Form W-9. This single step prevents most 1099 headaches.

What Form W-9 tells you:

- Legal name and business name

- Business structure

- Tax ID number (SSN or EIN)

- Address

How to collect W-9s:

- Make it part of your vendor onboarding. No W-9, no first payment

- Send it digitally via email or DocuSign

- Follow up on missing forms promptly

- Store them securely for at least four years

Effective vendor management includes systematizing your W-9 collection process from day one.

If a contractor refuses: You can withhold payment until they provide a W-9, or withhold 24% of the payment for backup withholding and send it to the IRS. Document all attempts to collect the form.

Filing Deadlines and Requirements

January 31 Deadline

- Form 1099-NEC: Recipient copy AND IRS copy both due

- Form 1099-MISC (attorney fees): All copies due

- Form 1099-INT: Recipient copy due

Late February and Late March Deadlines

- Form 1099-MISC (other boxes): February 28 (paper) or March 31 (electronic) for IRS filing

- Form 1099-INT (IRS copy): February 28 (paper) or March 31 (electronic)

Electronic Filing Requirements

If you’re filing 10 or more of any single form type, electronic filing is mandatory. The IRS offers free filing through their FIRE system, or use tax software and services.

Penalties for Non-Compliance

The IRS doesn’t mess around. Penalties escalate based on timing:

- Filed within 30 days late: $60 per form

- Filed 31 days late through August 1: $120 per form

- Filed after August 1 or not filed: $310 per form

- Intentional disregard: $630 per form with no cap

These penalties apply separately for failing to give the recipient their copy AND for failing to file with the IRS. Miss both, and you’re paying twice.

Setting Up Your 1099 System

A good system makes compliance almost automatic.

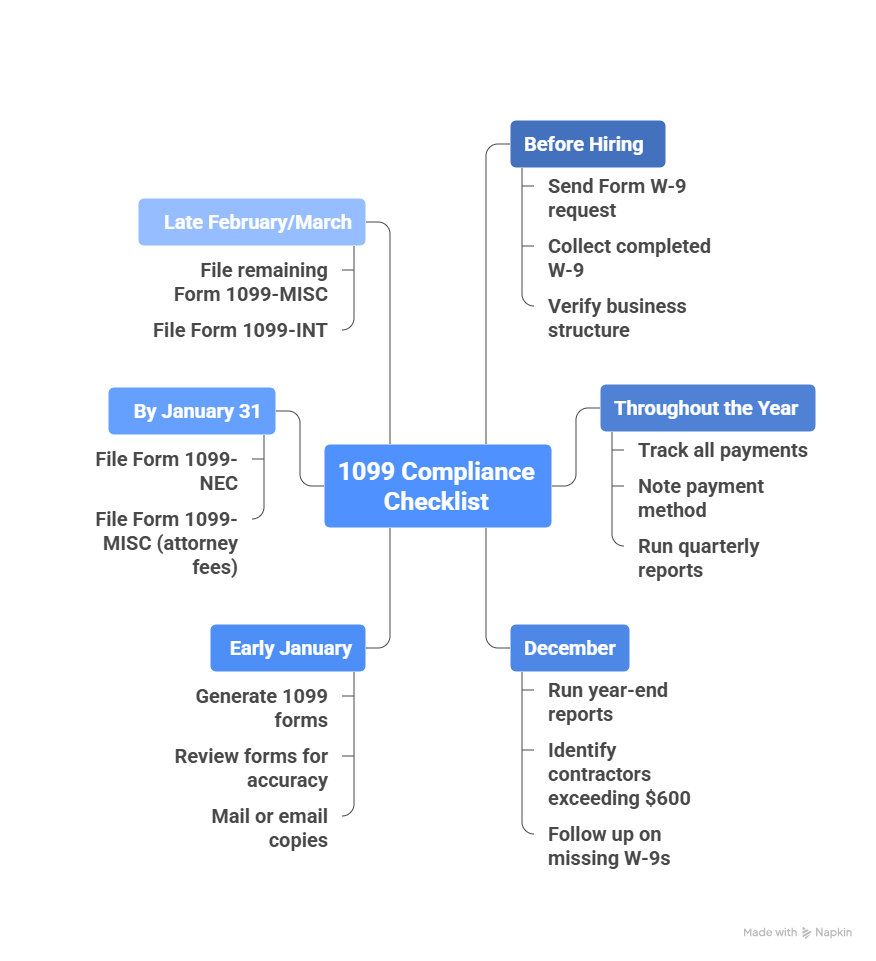

Year-Round Process

January-November: Collect W-9s from new contractors before first payment. Track all payments in your accounting system, noting payment method. Proper expense tracking makes year-end 1099 preparation much easier.

December: Run reports showing total payments to each contractor. Identify anyone who received $600+. Send W-9 requests to contractors you’re missing.

Early January: Generate 1099 forms using your accounting software or a 1099 service. Review for accuracy. Mail or email recipient copies by January 31.

By January 31: File 1099-NECs with the IRS.

Late February/March: File remaining 1099-MISC or 1099-INT forms.

Ongoing: Store copies of all filed forms, W-9s, and payment records for at least four years.

Software and Tools

Property management software that includes vendor tracking, payment management, and automated reporting makes 1099 compliance significantly easier. Propertese’s vendor management features help you track contractor payments, collect W-9s, and maintain organized records throughout the year. Combined with streamlined reporting, you can generate accurate 1099s without the manual spreadsheet work.

Special Situations Property Managers Face

Property Owners and Management Fees

When you collect rent from tenants and send it to individual property owners, you issue Form 1099-MISC (Box 1) to those owners reporting the rent you passed through. The rule is: whoever actually makes the payment has the reporting obligation.

Emergency Repairs and One-Time Vendors

If you hire an emergency contractor and they disappear before you get a W-9, you still need to issue a 1099. Use whatever information you have and document your attempts to collect the W-9.

Short-Term Rentals

Airbnb and VRBO send you Form 1099-K showing gross bookings. You still report contractor payments (cleaners, maintenance workers) following normal 1099 rules. Understanding state-specific property management requirements helps ensure you’re meeting all compliance obligations.

Common Mistakes and How to Avoid Them

Waiting until December to collect W-9s: Contractors are harder to reach during holidays. Collect W-9s before making the first payment. Automating vendor onboarding helps ensure you never skip this step.

Assuming LLCs don’t need 1099s: Many LLCs are taxed as sole proprietorships or partnerships and DO need 1099s. The W-9 shows tax classification.

Forgetting the attorney exception: Attorneys need 1099s even if incorporated. Create a separate category in your accounting system for legal fees.

Not tracking payment methods: Your accounting system should note payment method for every transaction. Filter out credit card payments when running year-end reports.

Missing the January 31 deadline for 1099-NEC: No extensions available. Set an internal deadline of January 20 for buffer time.

What to Do If You Made a Mistake

Filed late: File as soon as possible. The longer you wait, the higher the penalty tier.

Wrong amount or information: File a corrected 1099 immediately. Check the “CORRECTED” box and file it with the IRS. Send a corrected copy to the recipient.

Forgot to file entirely: File immediately once you discover the error. Document why the error occurred and what you’ve done to prevent it.

Reasonable cause request: If the IRS assesses penalties and you believe you have reasonable cause (natural disaster, serious illness, death of key employee, incorrect professional advice), write a detailed explanation and submit Form 843.

First-time penalty abatement is also available if you have a clean compliance history.

Final Thoughts: Make 1099 Compliance Routine

1099 compliance doesn’t have to be painful. With the right system, it becomes a predictable annual routine rather than a January panic.

The key habits:

- Get W-9s upfront, always

- Track payments and methods systematically

- Use software that handles the heavy lifting

- Don’t wait until December to start thinking about it

- File electronically when required

Most property managers find that once they set up proper systems: vendor files, W-9 collection workflows, and integrated property management software, 1099 season becomes straightforward.

The contractors get their forms on time. The IRS receives accurate information. You avoid penalties and keep your deductions. Everyone wins.

Table of Contents

Stay Updated

Subscribe to get the latest news, industry trends, blog posts, and updates...