The operating expense ratio is a fast way to see how efficiently a property turns revenue into results. In plain terms, it shows the share of income consumed by day-to-day operating costs. What counts as “good” depends on asset type and context, but most commercial properties land between 30% and 50%, with industrial assets often lower (15–25%) and hotels higher (50–65%). A “good” OER is one that’s competitive for your property class and market while still funding appropriate maintenance and service levels. Used effectively, the metric helps owners and managers benchmark performance, flag inefficiencies, and guide budgeting—especially when paired with trend data and peer comparisons.

Key takeaways:

- OER = Operating Expenses ÷ Gross Operating Income; many commercial assets fall roughly between 30% and 50%.

- Benchmarks vary by asset type and lease structure: industrial tends to be lower; hospitality tends to be higher.

- Use consistent definitions and compare against local peers over multi-year trends for meaningful insights.

- OER excludes financing costs and capital expenditures; pair it with NOI and cap rate for valuation decisions.

- Manage OER through standardized accounting, competitive bidding, and targeted efficiency investments.

Understanding Operating Expense Ratio in Real Estate

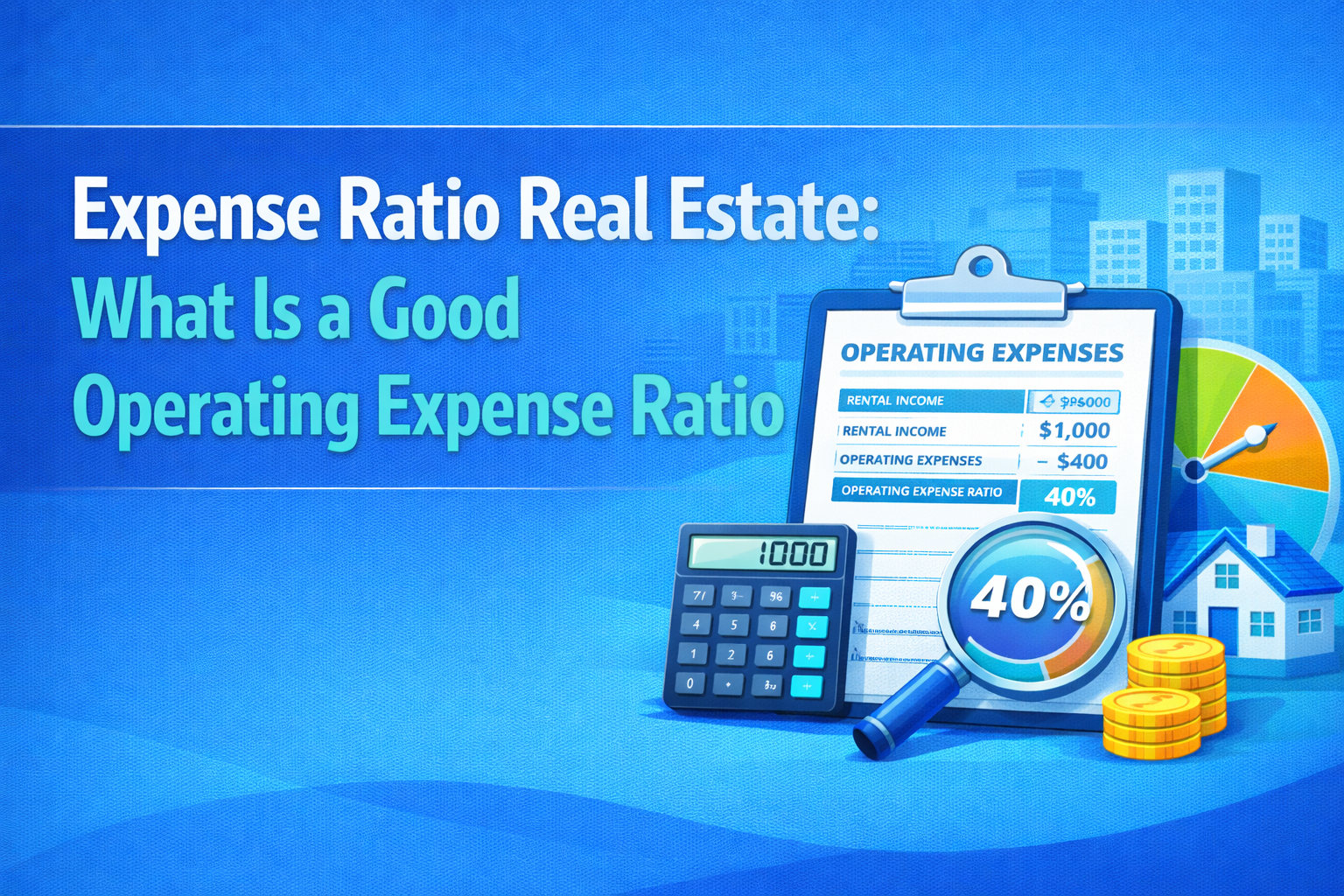

The operating expense ratio (OER) measures a property’s operating cost compared to the income it generates. In short: “Operating Expense Ratio = operating expenses divided by gross operating income, expressed as a percentage,” as summarized in this Investopedia overview. Operating expenses typically include repairs and maintenance, insurance, property taxes, utilities, and management fees. They exclude mortgage payments, income taxes, and capital expenditures such as roof replacements or major systems upgrades.

Why it matters: OER reveals what proportion of revenue is absorbed by operations. As the FathomHQ KPI glossary notes, “OER shows what percent of revenue is used for operating costs; it’s key for financial health.” For property and asset managers, the ratio serves as a diagnostic: stable or improving OERs indicate cost discipline and healthy operations; rising figures warrant a closer look at line items, contracts, or building systems.

How to Calculate Operating Expense Ratio

The core formula is straightforward:

- Operating Expense Ratio = (Operating Expenses ÷ Gross Operating Income) × 100.

Practical guidance:

- Be consistent about what you include as operating expenses; exclude financing costs and capital expenditures.

- Some variations subtract depreciation from expenses; standards matter because differing treatments can skew comparisons across assets and portfolios.

- Use effective gross income for multi-unit portfolios, which adjusts for vacancy and credit loss so you’re benchmarking based on the revenue actually realized.

Worked example:

- If annual operating expenses are $200,000 and gross operating income is $500,000, OER = (200,000 ÷ 500,000) × 100 = 40%.

Typical Operating Expense Ratio Benchmarks by Property Type

OER norms vary by asset class, lease structure, and service level. The following guidelines reflect common commercial real estate ranges:

| Property type | Typical OER range | Notes |

|---|---|---|

| Industrial | 15–25% | Often lower due to triple-net leases and minimal shared services. |

| Retail | 20–30% | Highly dependent on lease type (NNN vs. gross) and common area costs. |

| Multifamily | 35–45% | Higher staffing, turn costs, and utilities can increase OER. |

| Office | 35–55% | Amenities, HVAC, and service levels drive variability. |

| Hospitality/Hotels | 50–65% | Labor- and service-intensive operations elevate ongoing expenses. |

Across many commercial assets, 30–50% is a reasonable frame of reference, but your true benchmark depends on lease structure, property condition, and local norms. Treat benchmarks as guides: compare against similar local properties and account for unique circumstances. Unusually low OERs can indicate underinvestment; higher-than-average figures may signal inefficiency or genuinely higher service requirements.

Factors Influencing a Good Operating Expense Ratio

A “good” OER is context-sensitive. Key drivers include:

- Market conditions: Local utility rates, tax assessments, and vendor pricing vary widely.

- Physical condition: Older buildings and deferred maintenance elevate repairs and utilities.

- Service level: Amenities, security, and on-site staffing increase recurring costs.

- Lease structure: Net leases shift many operating expenses to tenants; gross leases centralize costs with the owner.

- Competition: Market positioning and tenant expectations influence cost decisions and acceptable ratios.

In practice, set targets by asset class and market, then refine them with your property’s age, systems, and lease mix. Track multi-year trends to understand whether changes reflect strategy (e.g., upgraded service levels) or drift (e.g., expense creep).

Limitations and Interpretation of OER

Used alone, OER has blind spots:

- It excludes financing costs and capital expenditures, so it doesn’t reflect full investment performance or asset value.

- Reporting choices, including how depreciation is handled, can shift the apparent ratio and reduce comparability.

- Very low OER can indicate under-resourcing or deferred maintenance; a rising OER over time can signal inefficiency or aging systems.

Interpretation tips:

- Normalize inputs (consistent chart of accounts and definitions).

- Compare like with like (asset class, size, market, and lease structure).

- Evaluate trends over several years, not one-off snapshots.

Strategies for Managing and Optimizing OER

Practical levers to control operating expenses and sustain performance:

- Standardize your chart of accounts and review OER monthly and quarterly to flag anomalies early; cadence matters because “monthly reviews catch anomalies quickly; quarterly analysis finds trends in OpEx.”

- Competitively bid insurance, utilities, janitorial, landscaping, and maintenance contracts on a defined cycle.

- Invest in cost-saving capital improvements: energy-efficient lighting, controls, HVAC retrofits, and insulation can reduce OpEx over time.

- Build contingency reserves—commonly 5–10% of annual operating budget or 1.5–2 months of OpEx—to avoid deferral during surprises.

- Reassess make/buy decisions: outsourcing certain functions can improve scalability and cost predictability; in-house teams can excel where responsiveness and quality control matter.

- Use OER actively: benchmark against peer sets, link to budgets, and incorporate into vendor performance reviews.

Propertese centralizes your operating data, automates expense categorization, and integrates with your ERP to standardize OER definitions across the portfolio. With real-time dashboards and automated alerts, teams can quickly spot expense creep and coordinate corrective actions through unified workflows. Explore how Propertese streamlines commercial operations (Propertese commercial property management) and our guidance on property bookkeeping fundamentals (Propertese bookkeeping best practices).

Using OER Alongside Other Financial Metrics for Asset Valuation

OER gauges cost efficiency; it doesn’t reveal market value. For valuation, pair it with net operating income (NOI) and cap rate.

- Net Operating Income (NOI) is gross operating income minus operating expenses; it drives cap rate and valuation.

- Cap rate relates NOI to market value; it reflects return expectations and market risk.

Comparison at a glance:

| Metric | What it measures | Formula | Primary use case |

|---|---|---|---|

| OER | Cost efficiency | Operating Expenses ÷ Gross Operating Income | Benchmarking operating performance and expense discipline |

| NOI | Earnings power | Gross Operating Income − Operating Expenses | Underwriting, budgeting, debt coverage analysis |

| Cap rate | Market valuation signal | NOI ÷ Property Value | Pricing, acquisition/disposition decisions, market comparables |

Bring these metrics together for a complete view: OER to control costs, NOI to assess earnings, cap rate to understand price and risk. Lenders and investors expect this triangulation in diligence, alongside reserves and forward-looking OpEx assumptions.

Best Practices for Tracking and Benchmarking Operating Expense Ratio

A repeatable governance process keeps OER accurate and actionable:

- Review OER monthly to catch anomalies; assess quarterly for trendlines and seasonality.

- Benchmark against peers in your asset class and submarket rather than universal thresholds; adjust for lease structure and service level.

- Instrument your data: Propertese automates reporting, enforces a consistent chart of accounts, and unifies invoices, contracts, and meter data for audit-ready transparency (Propertese accounting and financial management).

- Stay ahead of structural shifts. ESG requirements, rising energy prices, and evolving regulations are reshaping operating cost profiles—a trend highlighted in PwC’s Emerging Trends in Real Estate 2025.

Frequently Asked Questions

What is the operating expense ratio (OER) in real estate?

The operating expense ratio quantifies the percentage of gross operating income used to cover a property’s operating expenses, indicating cost efficiency.

What is considered a ‘good’ operating expense ratio for real estate properties?

It varies by property type, but 30–50% is typical for many commercial assets; industrial can be lower and hospitality higher.

How do you calculate the operating expense ratio?

Divide total operating expenses by gross operating income and multiply by 100 to express the result as a percentage.

Does the OER include mortgage payments or capital expenditures?

No. OER includes routine operating costs (repairs, taxes, insurance, utilities, management fees) and excludes mortgage payments and capital expenses.

Why do OER benchmarks vary by property type?

Operating costs, lease structures, and service levels differ across asset classes such as office, multifamily, retail, and hospitality.

How often should I review my OER for effective property management?

Monthly checks with quarterly trend reviews work best to surface anomalies and track efficiency over time.

Internal resources:

- See how Propertese scales commercial portfolios with integrated workflows (Propertese commercial property management).

- Get practical accounting guidance to tighten expense controls (Propertese rental income accounting guide).

Table of Contents

Stay Updated

Subscribe to get the latest news, industry trends, blog posts, and updates...